The operating profit ratio is one measure of relative change in these other expenses. This ratio indicates the percentage of sales revenue left to cover interest and income taxes expenses after deducting cost of goods sold and operating expenses. In other words:

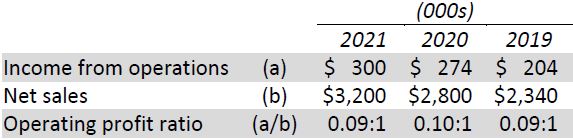

BDCC’s operating profit ratio for the 2019, 2020, and 2021 fiscal years is calculated as follows:

For each dollar of sales revenue in 2021, the company had $0.09 left to cover interest and income tax expenses after deducting cost of goods sold and operating expenses. A review of the company’s operating expenses (selling, general, and administrative expenses; employee benefits, and depreciation) show that they have all increased. As a result, and despite increasing sales revenue and gross profit, operating income has remained relatively flat. Although it seems reasonable that an increase in operating expenses would follow an increase in sales, the reasons for the operating expense increases should be investigated.

- 2147 reads