The sale of partnership assets may result in a debit balance in one partner’s capital account following allocation of the loss. Assume that sale of the previous $32,000–worth of other assets realizes only $8,000.

The following entry records the sale:

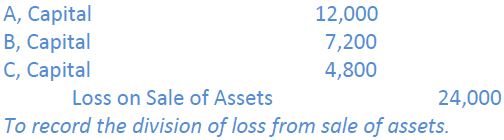

This $24,000 loss is next allocated to each partner in accordance with the 5:3:2 profit and loss sharing ratio.

The payment of liabilities is then recorded.

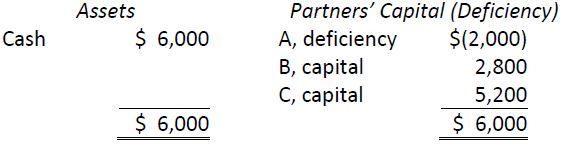

The partnership balance sheet now appears as follows:

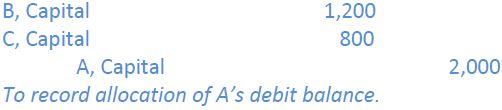

Partner A has a deficiency (debit balance) in his capital account. A would be expected to contribute $2,000 cash to the partnership to make up this debit balance. If A does not contribute this amount, then this $2,000 debit balance is allocated to the remaining partners in their agreed profit and loss sharing ratio, in this case 3:2. The following entry illustrates the allocation of A’s debit balance to B and C.

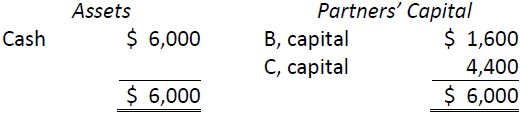

At this point, the partnership balance sheet shows:

The distribution of cash to B and C would be recorded by the following entry, and the liquidation would be complete:

- 2505 reads