The statement of changes in equity provides information about how the balances in Share capital and Retained earnings changed during the period. Share capital is a heading in the shareholders’ equity section of the balance sheet and represents how much shareholders have invested. When shareholders buy shares, they are investing in the business. The number of shares they purchase will determine how much of the corporation they own. The type of ownership unit purchased by Big Dog’s shareholders is known as common shares. These and other types of shares will be discussed in a later chapter. For now, all ownership units will be called share capital. When a corporation sells its shares to shareholders, the corporation is said to be issuing shares to shareholders.

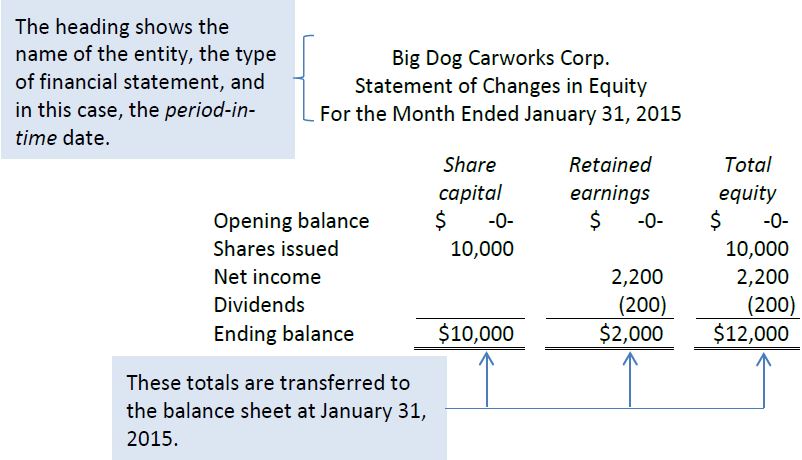

In the statement of changes in equity shown below, share capital and retained earnings balances at January 1 are zero because the corporation started the business on that date. During January, share capital of $10,000 was issued to shareholders so the January 31 balance is $10,000.

Retained earnings is the sum of all net incomes earned by a corporation over its life, less any distributions of these net incomes to shareholders. Distributions of net income to shareholders are called dividends. Shareholders generally have the right to share in dividends according to the percentage of their ownership interest. To demonstrate the concept of retained earnings, recall that Big Dog has been in business for one month in which $2,200 of net income was reported. If dividends of $200 are distributed, these are subtracted from retained earnings. Big Dog’s retained earnings are therefore $2,000 at January 31, 2015 as shown in the statement of changes in equity below.

To demonstrate how retained earnings would appear in the next accounting period, let’s assume that Big Dog reported a net income of $5,000 for February, 2015 and dividends of $1,000 were paid to the shareholder. Based on this information, retained earnings at the end of February would be $6,000, calculated as the $2,000 January 31 balance plus the $5,000 February net income less the $1,000 February dividend. The balance in retained earnings continues to change over time because of additional net incomes/losses and dividends.

- 14401 reads