LO1 – Describe how the cost of property, plant, and equipment (PPE)is determined, and calculate PPE.

Property, plant, and equipment (PPE) are tangible, long-lived assets that are acquired for the purpose of generating revenue either directly or indirectly. A capital expditure is debited to a PPE asset account because it results in the acquisition of a non-current asset and includes any additional costs involved in preparing the asset for its intended use at or after initial acquisition. A revenue expenditure does not have a future benefit beyond one year so is expensed. The details regarding a PPE asset are maintained in a PPE subsidiary ledger.

LO2 – Explain, calculate, and record depreciation using the units-of-production, straight-line, and double-declining balance methods.

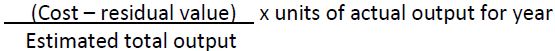

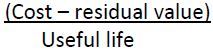

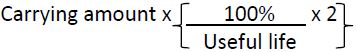

Depreciation allocates the cost of a PPE asset (except land) over the accounting periods expected to receive benefits from its use. A PPE asset’s cost, residual value, and useful life or productive output are used to calculate depreciation. There are different depreciation methods. Units-of-production is a usage-based method. Straight-line and double-declining balance are time-based methods. The formulas for calculating yearly depreciation expense using these methods are:

Units of production:

Straight-line:

Double-declining balance:

Under DDB, depreciation expense in subsequent years is calculated based on the prior year’s carrying amount.

Under all methods, carrying amount cannot be less than residual value.

LO3 – Explain, calculate, and record depreciation for partial years.

When assets are acquired or derecognized partway through the accounting period, partial period depreciation is recorded. There are several ways to account for partial period depreciation. The half-year rule assumes six months of depreciation in the year of acquisition and year of derecognition regardless of the actual date these occur.

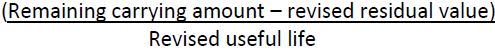

LO4 – Explain, calculate, and record revised depreciation for subsequent capital expenditures.

When there is a change that impacts depreciation (such as a change in the estimated useful life or estimated residual value, or a subsequent capital expenditure) revised depreciation is applied prospectively –that is, prior accounting periods’ expenses are not changed. The calculation is:

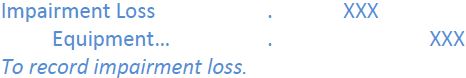

LO5 – Explain, calculate, and record the impairment of long-lived assets.

The recoverable amount of a long-lived asset must be compared with its carrying amount at the end of each reporting period. The recoverable amount is the fair value of the asset at the time less any estimated costs to sell it. If the recoverable amount is lower than the carrying amount, an impairment loss is recorded as:

LO6 – Account for the derecognition of PPE assets.

Property, plant, and equipment is derecognized when it is sold or when no future economic benefit is expected. To account for the disposal of a PPE asset, the following must occur:

|

1. |

If the disposal occurs part way through the accounting period, depreciation must be updated to the date of disposal by this type of adjusting entry: |

|

|

|

2. |

The disposal, including any resulting gain or loss, is recorded by this type of adjusting entry: |

|

|

|

A loss results when the carrying amount of the asset is greater than the proceeds received, if any. A gain results when the carrying amount is less than any proceeds received. |

|

|

It is a common practice to exchange a used PPE asset for a new one, known as a trade-in. The value of the trade-in is called the trade-in allowance and is applied to the purchase price of the new asset so that the purchaser pays the difference. Sometimes the trade-in allowance is higher than the fair value of the used asset. The cost of the new asset must be recorded at its fair value, calculated as: |

|

|

Cost of new asset = Cash paid + Fair value of asset traded |

|

|

If there is a difference between the fair value of the old asset and its carrying value, a gain or loss results. |

|

LO7 – Explain and record the acquisition and amortization of intangible assets.

Intangible assets are long-lived assets that arise from legal rights and do not have physical substance. Examples include patents, copyrights, trademarks, and franchises. Intangibles are amortized using the straight-line method. The entry to record amortization is a debit to amortization expense and a credit to the intangible asset—there is no accumulated amortization account.

LO8 – Explain goodwill and identify where on the balance sheet it is reported.

Goodwill is a long-lived asset that does not have physical substance but it is not an intangible. When one company buys another company, goodwill is the excess paid over the fair value of the net assets purchased and represents the ability to generate superior future earnings compared to other companies in the same industry. Goodwill appears in the asset section of the balance sheet under its own heading of “Goodwill.” It is not amortized.

LO9 – Describe the disclosure requirements for long-lived assets inthe notes to the financial statements.

When long-lived assets are presented on the balance sheet, the notes to the financial statements need to disclose the following:

- details of each class of assets (e.g., land; equipment including separate parts; patents; goodwill)

- measurement basis (usually historical cost)

- type of depreciation and amortization methods used, including estimated useful lives

- cost and accumulated depreciation at the beginning and end of the period, including additions, disposals, and impairment losses

- whether the assets are constructed by the company for its own use (if PPE) or internally developed (if intangible assets).

- 2093 reads