Not all bonds are issued on the date when interest begins to accumulate. For example, consider the sale of an additional $50,000 of 12% BDCC bonds on April 1, 2015. Interest began to accumulate on January 1 per the terms of the bond indenture and, regardless of the date on which the bonds were issued, a six-month interest payment is made to the bondholders on June 30. This $3,000 payment ($50,000 x 12% x 6/12 mos.) is owing to the bondholders even though the bond has been issued for only three months, from April 1 to June 30.

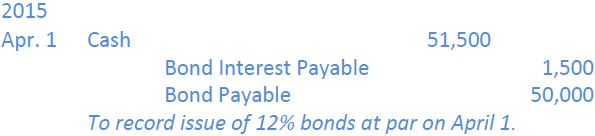

If the bond is sold between interest dates, the purchaser pays the accrued interest at the date of purchase to the issuer, since the purchaser will get the full six months of interest in cash on June 30, having only held the bonds for three months. In this case, $1,500 of interest has accrued on the bond from January 1 to April 1 ($50,000 x 12% x 3/12 mos.). Assuming the bonds are issued at par, the purchasers would pay a total of $51,500. The corporation would record the bond issue as follows:

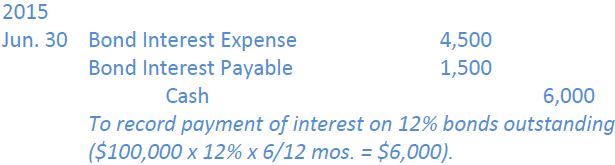

The regular semi-annual interest payment on the $100,000 of issued bonds is then made on June 30. It is recorded as follows:

In this way, interest expense is recorded on $50,000 of the bonds for three months ($50,000 x 12% x 3/12 mos. = $1,500) and for the remaining $50,000 of bonds for six months ($50,000 x 12% x 6/12 mos. = $3,000), for a total of $4,500.

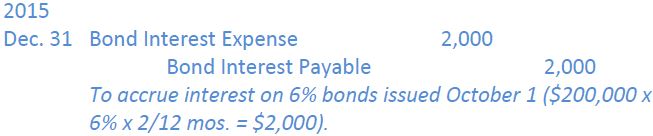

If the bond has interest payment dates that do not coincide with the year-end of the issuing corporation, an adjusting journal entry is required at year-end to record interest owing at that date. Assume a corporation issued $200,000, 6% bonds on October 1, 2015 that pay interest semi-annually on April 1 and September 30. If it has a December 31 year-end, the following entry would be made at that date:

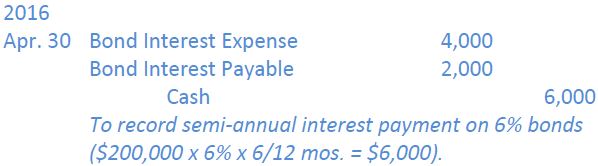

When the semi-annual payment is made on April 1 of the next year, this entry is made:

- 1848 reads