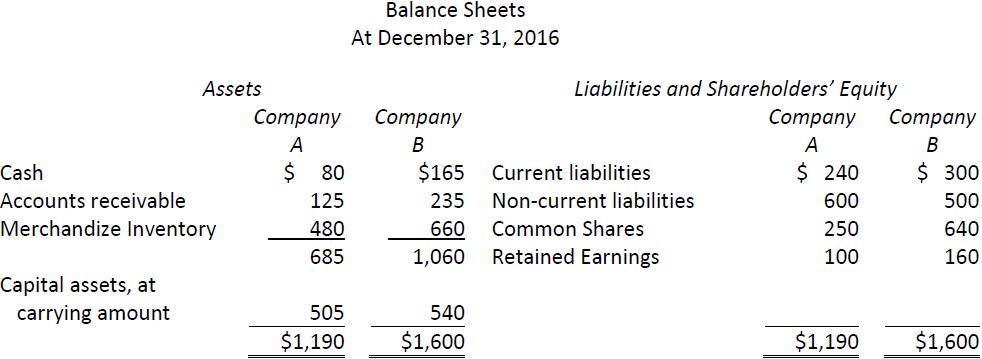

Assume you are the bank manager of Third National Bank. Two companies, A and B, are seeking bank loans. You are given the following financial statements.

|

Required: |

||

|

1. |

From this information, calculate for each company |

|

|

Current ratio Acid-test ratio Accounts receivable collection period Number of days of sales in inventory Revenue operating cycle Return on total assets Return on shareholders’ equity Debt to shareholders’ equity ratio Times interest earned Sales to total assets ratio Gross profit ratio Net profit ratio |

||

|

Assume averages equal ending balances where necessary. |

||

|

2. |

Choose one company to which you would grant a 6-month, 6% loan of $150. Give reasons for your choice. |

|

|

3. |

(Appendix) Restate the financial statements to facilitate Scott formula analysis and calculate the formula. Assume current liabilities all relate to operations. Does this additional information change your decision in (2) above? Explain. |

|

- 1814 reads