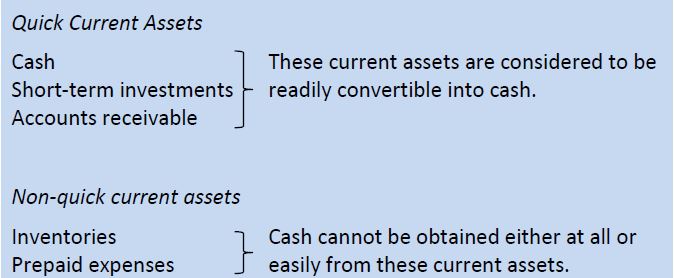

A more rigid test of liquidity is provided by the acid-test ratio; also called the quick ratio. To calculate this ratio, current assets are separated into quick current assets and non-quick current assets.

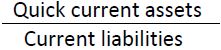

Inventory and prepaid expenses cannot be converted into cash in a short period of time, if at all. Therefore, they are excluded in the calculation of this ratio. The acid-test ratio is calculated as:

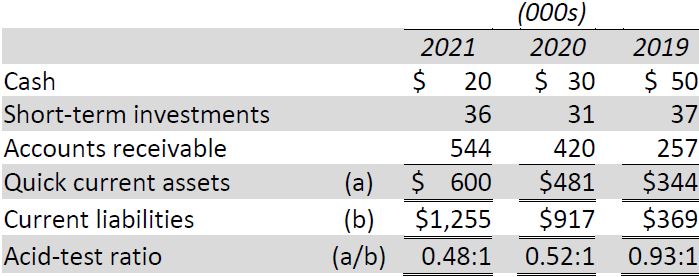

The BDCC information required to calculate this ratio is:

This ratio indicates how many quick asset dollars exist to pay each dollar of current liabilities. What is an adequate acid-test ratio? It is generally considered that a 1:1 acid test ratio is adequate to ensure that a firm will be able to pay its current obligations. However, this is a fairly arbitrary guideline and is not appropriate in all situations. A lower ratio than 1:1 can often be found in successful companies. However, BDCC’s acid-test ratio trend is worrisome.

There was $0.48 of quick assets available to pay each $1 of current liabilities in 2021. This amount appears inadequate. In 2020, the acid-test ratio of $0.52 also seems to be too low. The 2019 ratio of $0.93 is less than 1:1 but may be reasonable. Of particular concern to financial analysts would be BDCC’s declining trend of the acid-test ratio over the three years.

Additional analysis can also be performed to determine the source of liquidity issues. These are discussed next.

- 2951 reads