Another type of known current liabilities is a sales tax. Sales taxes are common sources of government revenues in most countries. An example of a Canadian sales tax is the federal Goods and Services Tax(GST) . This is calculated as 5% of the selling price of most goods and services. 1 GST does not apply to salaries, wages and benefits paid to employees.

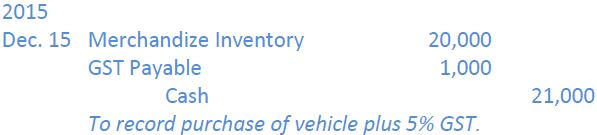

To demonstrate how a sales tax like GST is recorded, assume that a Joe’s Cars Corporation operates in Canada. The company purchased a vehicle for $20,000 cash from a supplier on December 15, 2015. It must pay the supplier $21,000: $20,000 for the vehicle GST of $1,000 (20,000 x 5% = $1,000). The entry to record the purchase would be:

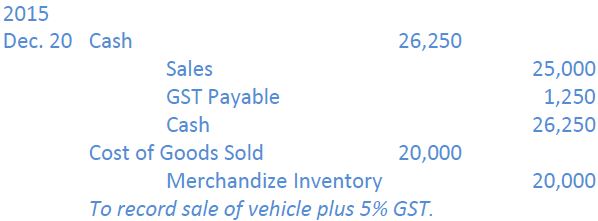

Assume the company then sold the vehicle to a customer on December 20 for $25,000 cash. The customer must pay Joe’s Cars $26,250: $25,000 for the vehicle plus GST of $1,250 ($25,000 x 5% = $1,250). If the company uses the perpetual inventory method, the entry to record the sale would be:

There is no GST effect related to cost of goods sold. This has been recorded when the vehicle was originally purchased on December 15. The balance sheet at December 31 would show a current liability, GST Payable, amounting to $250 ($1,250 – 1,000). No expense would be recorded on the company’s income statement. The GST Payable liability of $250 would be paid to the government soon after the balance sheet date. Assuming this payment is made on January 15, 2016, the following journal entry would be made:

- 2090 reads