Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

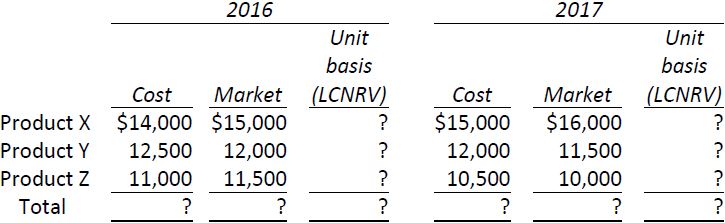

Reflex Corporation sells three products. The inventory valuation of these products is shown below for years 2016 and 2017.

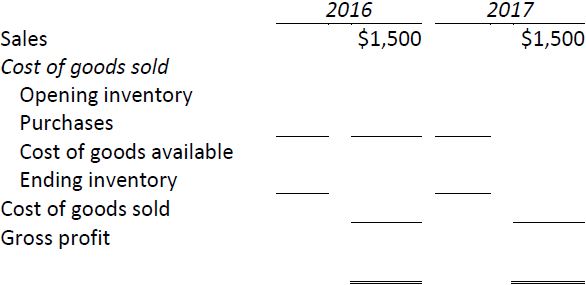

The partial comparative income statements for the two years follow:

Required:

- If Reflex values its inventory using LCNRV/unit basis, complete the 2016 and 2017 cost, net realizable value, and LCNRV calculations.

- Complete the partial income statements for 2016 using cost, LCNRV/unit basis, and LCNRV/group basis to calculate ending inventory and cost of goods sold.

- Complete the partial income statements for 2017 using cost, LCNRV/unit basis, and LCNRV/group basis to calculate ending inventory and cost of goods sold.

- Which inventory valuation would yield the same gross profits for 2016 and 2017?

- Cost and LCNRV/unit basis

- Cost and LCNRV/group basis

- Cost basis.

- Which methods yield the maximum combined profits for both years?

- 2781 reads