| LO3 – Explain the purpose of and prepare a bank reconciliation, and record related adjustments. |

The widespread use of banks facilitates cash transactions between entities and provides a safeguard for the cash assets being exchanged. This involvement of banks as intermediaries between entities has accounting implications. At any point in time, the cash balance in the accounting records of a particular company usually differs from the bank cash balance of that company. Differences occur because some cash transactions recorded in the accounting records have not yet been recorded by the bank and, conversely, some cash transactions recorded by the bank have not yet been recorded in the company’s accounting records.

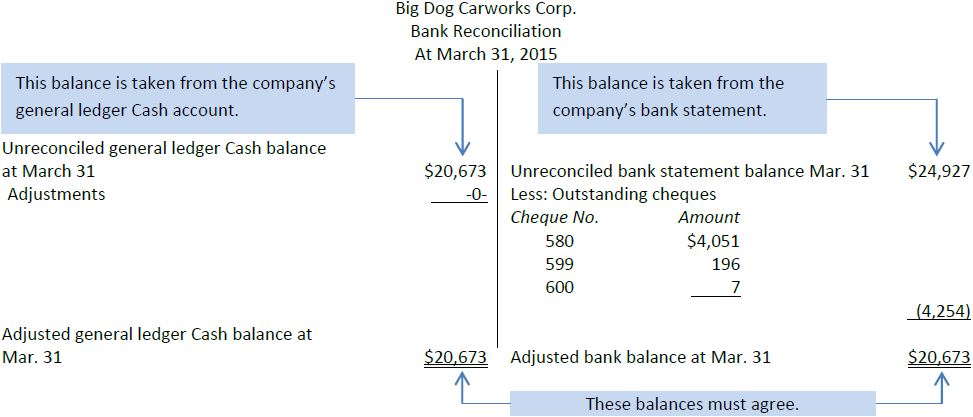

The use of a bank reconciliation is one method of internal control over cash. A bank reconciliation proves the accuracy of both the company’s and the bank’s records, and reveals any errors made by either party. The bank reconciliation is a tool that can help detect attempts at theft and manipulation of records. An example of a bank reconciliation for Big Dog Carworks Corp. is shown in Figure 7.1:

The bank reconciliation provides a simple method to show why the bank statement issued by the company’s bank and the Cash balance in a company’s general ledger differ on a given date like a month-end, and whether these differences are acceptable. In the example above, the difference ($20,673 versus $24,927) occurs because there are three cheques that have been recorded in BDCC’s general ledger Cash account totalling $4,254 that have not yet been presented and accepted for payment (or been cleared) by the bank. Cheques that are recorded in the company’s general ledger but are not paid out of its bank account when the bank statement is prepared are referred to as outstanding cheques. Outstanding cheques cause the bank statement balance to be overstated compared to the company’s records. These cheques must be subtracted from the bank balance on the bank reconciliation so that the Cash general ledger account and bank statement balances agree.

These outstanding cheques will likely be cashed by the bank a few days after the month end and appear on the next month’s bank statement. As a result, these differences are reasonable, occurring only because of slight timing differences between transactions being recorded in the general ledger and on the bank statement.

The steps needed to prepare a bank reconciliation are discussed below.

- 3432 reads