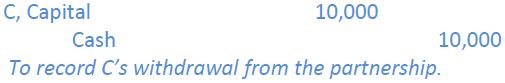

A third method involves a payment to the withdrawing partner for the amount of her capital balance. Assuming the payment is made in cash, the following entry would be prepared:

The balance sheet would now show:

Note that this transaction results in a $5,000 bank overdraft. The remaining partners will have to contribute more cash, or the partnership will have to sell of its assets for cash, or obtain a bank loan to cover the cash deficiency.

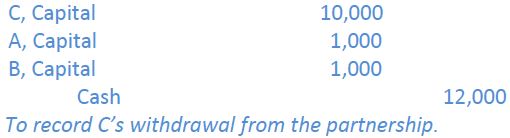

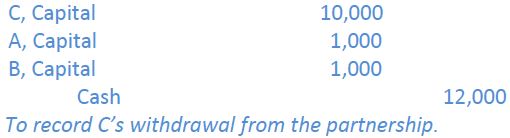

Often, the withdrawing partner may receive either more or less than the recorded capital balance. The difference can result from undervalued or overvalued partnership assets, anticipated future profitable operations in excess of normal returns to which the exiting partner is entitled, or to settle inter–personal conflicts among partners. As a result, the partners calculate an agreed amount that is due to C; the difference is treated as a bonus to either the withdrawing partner or the remaining partners. For instance, if C is paid $12,000, or $2,000 more than her capital balance, the capital balances of both A and B would each be reduced by $1,000.

In this case, the two remaining partners are assumed to share the difference equally. C, therefore, receives a total of $12,000, represented by the $10,000 capital balance and a bonus of $2,000, which is paid equally by A and B.

If C is paid $3,000 less than his capital balance, the capital balances of both A and B would be increased by $1,500.

C receives $7,000 in cash; the $3,000 difference, shared equally by A and B, increases their capital balances.

- 2642 reads