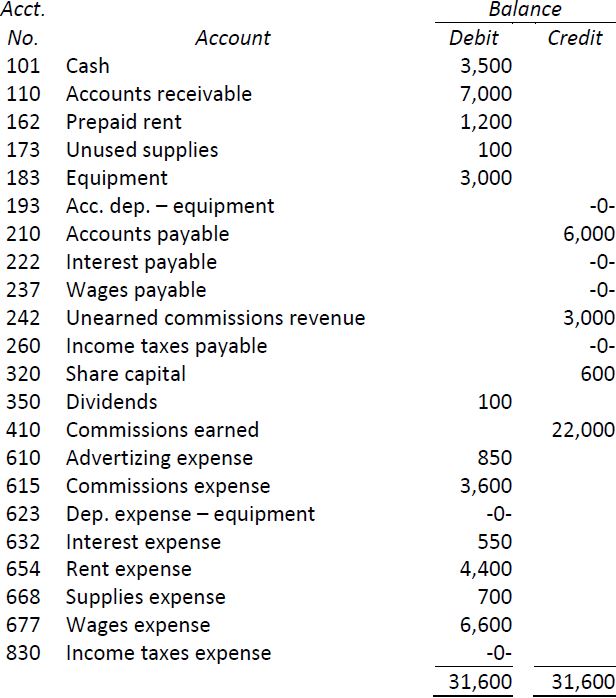

The following unadjusted trial balance has been prepared for Sellit Realty Corporation at the end of its first year of operations, December 31, 2016:

The following additional information is available:

|

a. |

Prepaid rent represents equal amounts of rent for the months of December 2016, and January and February 2017. |

|

b. |

A physical count indicates that $200 of supplies is on hand at December 31. |

|

c. |

The equipment was purchased on July 1; it has an estimated useful life of 3 years. |

|

d. |

Wages of $300 for December 30 and 31 are unpaid; they will be included in the first Friday’s payment in January. |

|

e. |

Revenue includes $2,500 received for commissions that will be earned in 2017. |

|

f. |

Unrecorded interest expense amounts to $150. |

|

g. |

Income taxes expense amounts to $200. This will be paid in the next fiscal year. |

Required:

- Prepare all necessary adjusting entries at December 31, 2016. Include general ledger account numbers and calculations as needed. Descriptions are not necessary.

- Prepare an adjusted trial balance.

- Prepare an income statement, statement of changes in equity, and balance sheet.

- Prepare closing entries including general ledger account numbers and descriptions.

- Prepare a post-closing trial balance.

- 2380 reads