The balance sheet, income statement, and statement of changes in equity of Big Dog Carworks Corp. for the years ended December 31, 2019 through 2021 were presented in Figure 13.1 of chapter 13. Refer to these.

Additional information:

|

1. |

Short-term investments are held to meet on-going cash requirements and are liquidated 120 days after acquisition. |

|

2. |

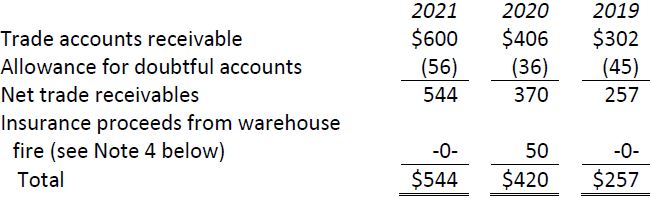

Accounts receivable consist of the following ($000s): |

|

3. |

Inventory at December 31, 2021 was reduced by $200,000 due to obsolescence of some items. |

|

4. |

During 2020, a warehouse building costing $100,000 and with a carrying amount of $47,000 was destroyed by fire. Insurance proceeds of $50,000 were received in 2009 and recorded as part of accounts receivable at December 31, 2020 (see note 2 above). The gain on disposal was recorded as part of selling, general, and administrative expenses on the 2020 income statement. There were no other disposals of property, plant, and equipment in 2020 and 2021. |

|

5. |

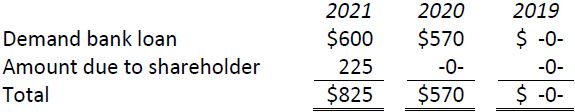

Borrowings consist of the following ($000s): The shareholder loan is subordinated to the demand bank loan. That is, it may not be repaid before the bank loan. |

|

6. |

Accounts payable at December 31, 2021 include $80,000 of dividends payable (2020 and 2019: $-0-). |

Required:

- Prepare cash flow tables for 2020 and 2021. State any assumptions you make.

- Prepare a comparative statement of cash flows for the years ended December 31, 2020 and 2021.

- Interpret the SCF results.

- 1845 reads