There are many types of shares, with differences related to voting rights, dividend rights, liquidation rights, and other preferential features. The rights of each shareholder depend on the class or type of shares held.

Every corporation issues common shares. The rights and privileges usually attached to common shares are outlined below.

- The right to participate in the management of the corporation by voting at shareholders’ meetings (this participation includes voting to elect a board of directors; each share normally corresponds to one vote).

- The right to receive dividends when they are declared by the corporation’s board of directors.

- The right to receive assets upon liquidation of the corporation.

- The right to appoint auditors through the board of directors.

For other classes of shares, some or all of these rights are usually restricted. The articles of incorporation may also grant the shareholders the pre-emptive right to maintain their proportionate interests in the corporation if additional shares are issued.

If the company is successful, common shareholders may receive dividend payments. As well, the value of common shares may increase. Common shareholders can submit a proposal to raise any matter at an annual meeting and have this proposal circulated to other shareholders at the corporation’s expense. If the corporation intends to make fundamental changes in its business, these shareholders can often require the corporation to buy their shares at their fair value. In addition, shareholders can apply to the courts for an appropriate remedy if they believe their interests have been unfairly disregarded by the corporation.

Some corporations issue different classes of shares in order to appeal to as large a group of investors as possible. This permits different risks to be assumed by different classes of shareholders in the same company. For instance, a corporation may issue common shares but divide these into different classes like class A and class B common shares. When dividends are declared, they might only be paid to holders of class A shares.

Shareholders who hold preferred shares are entitled to receive dividends before common shareholders. These shares usually do not have voting privileges. Preferred shareholders typically assume less risk than common shareholders. In return, they receive only a limited (but more predictable) amount of dividends. Issuing preferred shares allows a corporation to raise additional capital without requiring existing shareholders to give up control. Other characteristics of preferred shares and dividend payments are discussed later in this chapter.

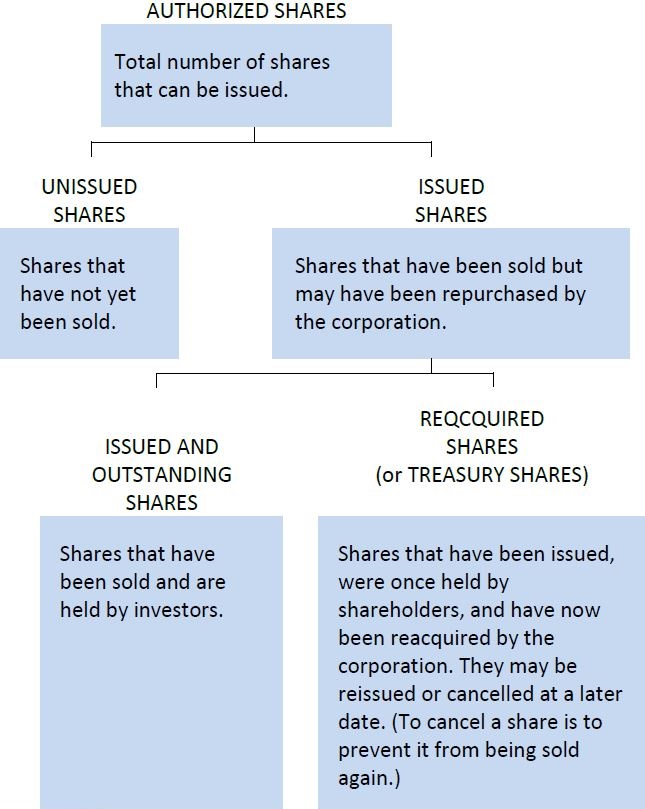

The shares of a corporation can have a different status at different points in time. They can be unissued or issued, issued and outstanding, or issued and reacquired by the corporation (called treasury shares). The meaning of these terms is summarized in Figure 11.2:

- 2246 reads