| LO2 – Describe how the financial statements of a proprietorship are different from those of a corporation. |

The financial statements for a proprietorship are much the same as those of a corporation. One difference is that the income statement of a proprietorship does not include income taxes expense (since its profits are included in the owner’s personal income tax return). As well, no salaries expense paid the proprietor is recorded on a proprietorship’s income statement, since the proprietor receives all the net income of the business. This is the owner’s remuneration.

The effects of these differences are shown in Figure 12.2, Assume a slight variation on the information presented above: revenue of $10,000, salaries to owner of $2,000, income taxes expense of $500, other expenses of $3,500. The 2016 income statements (bolded for illustrative purposes) would show:

Net incomes are different because salaries expense and income taxes expense are included in the corporation’s income statement, but excluded from the proprietorship’s income statement. Rather, these two expenditures are considered to be proprietor withdrawals, and are included in the statement of proprietor’s capital. This is illustrated below.

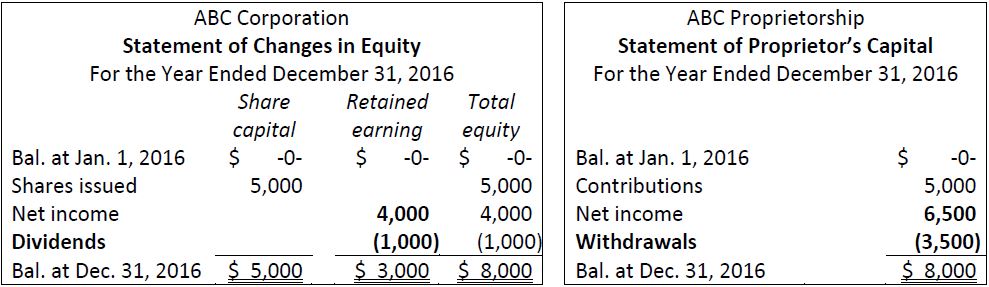

The statement of changes in equity for each of a proprietorship and corporation includes the same elements: beginning equity, additional investments by the shareholders/owner, net income, distribution of income to the shareholders/owner, and the ending equity. However, the proprietorship statement combines all the equity items in one account, the Proprietor’s Capital account. In a corporation, shareholders’ equity is divided between share capital and retained earnings. These differences are illustrated in Figure 12.3. Assume the same information as above. In addition, assume that no opening equity balances, shares issued/ proprietor’s contributions of $5,000 for the year, and cash dividends/withdrawals of $1,000. The statements of changes in equity (bolded for illustrative purposes) would show:

Although net income differs, ending total equity ($8,000) is the same in both cases. Salaries and income taxes expenses omitted on the proprietorship income statement are instead added to the proprietor withdrawals. These differences offset each other.

The balance sheet for each of a proprietorship and corporation includes the same elements: assets, liabilities, and equity. Only the equity section of the statement differs. In a proprietorship, all the equity items are combined in one account, the owner’s capital account. In a corporation, equity is divided between share capital and retained earnings. These differences are illustrated in Figure 12.4. Asset and liability amounts are all assumed. (Items are bolded for illustrative purposes.)

- 16124 reads