The following accounts are taken from the records of Bill Pitt Corp. at the end of its first 12 months of operations ended December 31, 2016, prior to any adjustments. In addition to the balances in each set of accounts, additional data are provided for adjustment purposes if applicable. Treat each set of accounts independently of the others.

Additional information: The truck was purchased July 1; it has an estimated useful life of 4 years.

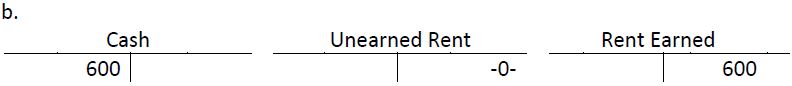

Additional information: A part of Harrison’s office was sublet during the entire 12 months for $50 per month.

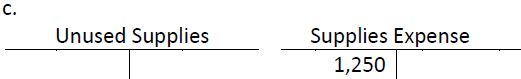

Additional information: A physical inventory indicated $300 of supplies still on hand at December 31.

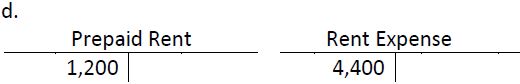

Additional information: The monthly rent is $400.

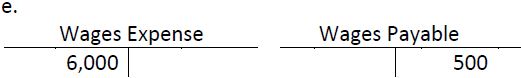

Additional information: Unrecorded wages at December 31 amount to $250.

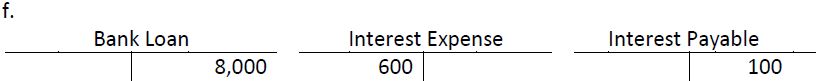

Additional information: Total interest expense for the year should be $800.

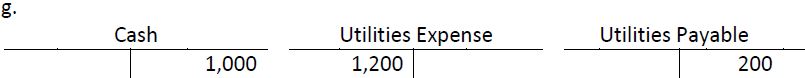

Additional information: The December bill has not yet been received or any accrual made; the amount owing at December 31 is estimated to be another $150.

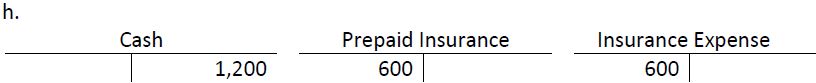

Additional information: A $1,200 one-year insurance policy had been purchased effective February 1, 2016; there is no other insurance policy in effect.

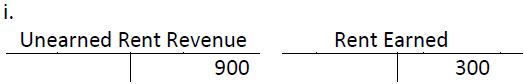

Additional information: The Unearned Rent Revenue balance applies to the months of November and December 2016 and to January 2017 at $300 per month.

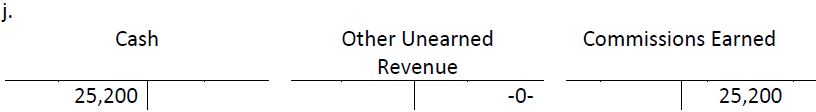

Additional information: An amount of $2,000 commission revenue has not been earned at December 31.

Required: Prepare all necessary adjusting entries and descriptions at December 31, 2016. General ledger account numbers are not necessary.

- 2090 reads