The comptroller of Exeter Services Ltd. has asked you to forecast the effect of rising and falling prices on income when FIFO and weighted average costing methods are used. The following inventory data are made available:

|

Opening inventory |

100 units at $10 = $1,000 |

|

Purchases |

500 units at $12 = $6,000 |

|

Ending inventory |

250 units |

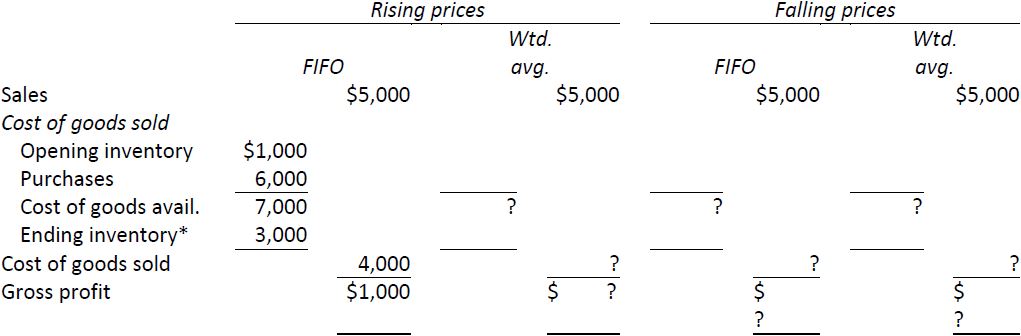

Partially completed income statements are as follows:

* 250 units at $12 = $3,000.

Required:

- Complete the statement for weighted average rising prices using the data provided. (Hint: you need to recalculate the ending inventory cost.)

- Complete the statement for FIFO falling prices. Assume that purchases were made at $8 per unit.

- Complete the statement for weighted average falling prices by assuming that purchases were made at $8 per unit. (Note that this changes cost of purchases and ending inventory cost.)

- Assume that income tax expense is calculated at 50 per cent of income before income taxes. Which costing method would be most tax-advantageous from the company’s point of view when prices are rising? When prices are falling?

- 2329 reads