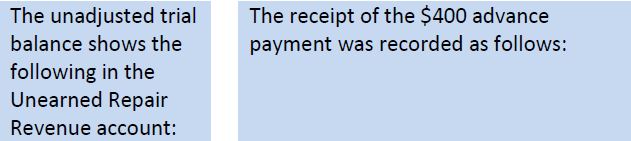

Recall from Chapter 2 (Transaction 7) that on January 15, Big Dog received a $400 cash payment in advance of services being performed: $300 for January and $100 for February.

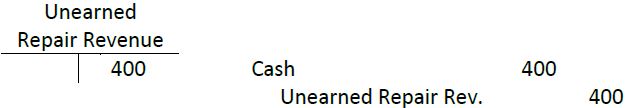

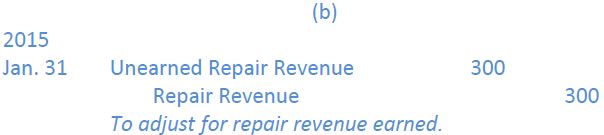

This advance payment was originally recorded as unearned revenue, since the cash was received before repair services were performed. Assume now that at January 31, $300 of the $400 unearned amount has been earned. Therefore, $300 must be transferred from unearned repair revenue into repair revenue. The adjusting entry at January 31 is:

After posting the adjustment, the $100 remaining balance in unearned repair revenue ($400 – $300) represents the amount at the end of January that will be earned in February.

If the adjustment was not recorded, unearned repair revenue would be overstated (too high) by $300 causing liabilities on the balance sheet to be overstated. Additionally, revenue would be understated (too low) by $300 on the income statement.

- 2583 reads