The return on shareholders’ equity ratio (ROSE) measures how much net income was earned for the amount shareholders have invested in a business. It is calculated as:

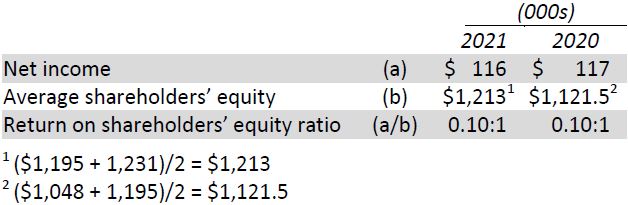

The 2020 and 2021 returns on shareholders’ equity ratios for BDCC are calculated as follows (note that the 2019 ratio is excluded; average shareholders’ equity cannot be calculated since 2018 ending balances are not provided):

In both years, shareholders earned, on average, $0.10 for every $1 invested in BDCC, or 10%. Industry averages could help with this analysis. For instance, if the industry as a whole earned only a 5% return on shareholders’ equity in 2021, it could be concluded that BDCC performed better than the industry average in terms of return on shareholders’ equity.

- 10821 reads