The process of closing the general ledger temporary accounts to retained earnings at the end of an accounting year is the same under the perpetual or periodic system, with one exception. Under the periodic system, an entry must be made in the Merchandize Inventory account to adjust this balance to the amount of inventory counted and valued at year-end. Otherwise, the steps are the same:

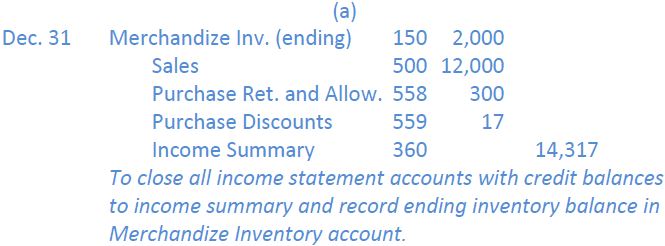

Entry 1

All income statement accounts with credit balances are debited to bring them to zero. Their balances are transferred to the income summary account. At the same time, the ending inventory balance($2,000 in this case) is debited to the Merchandize Inventory account.

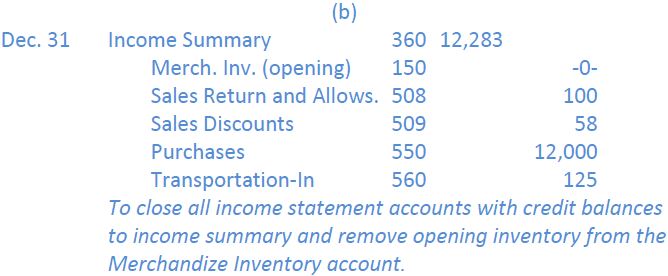

Entry 2

All income statement accounts with debit balances are credited to bring them to zero. Their balances are transferred to the Income Summary account. At the same time, the opening inventory balance(zero in this case) is credited to the Merchandize Inventory account:

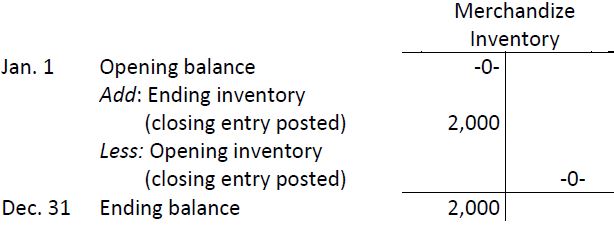

The combined effect of entries 1 and 2 on the Merchandize Inventory account is to adjust it to the actual ending balance at December 31 of $2,000. At the end of this process, the account will show:

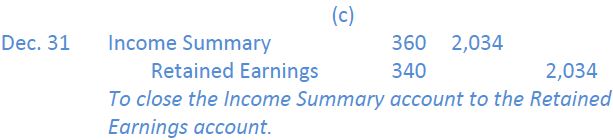

Entry 3

The income summary account is closed to the Retained Earnings account. The effect is to transfer temporary account balances in the income summary totalling $2,034 to the permanent general ledger account, Retained Earnings.

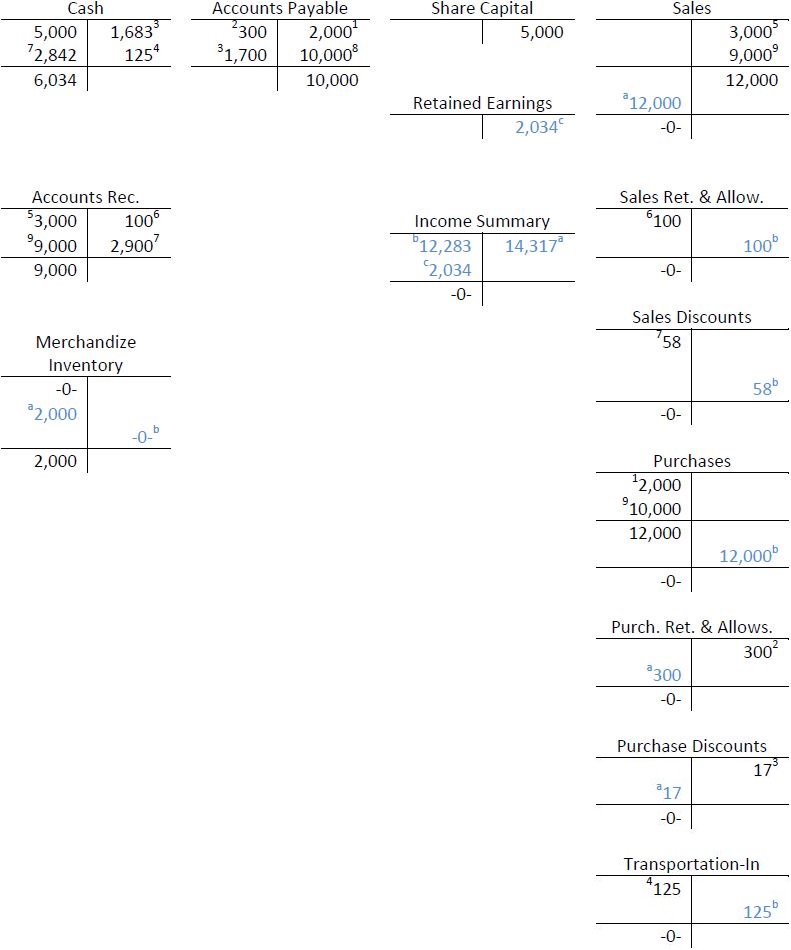

After these closing entries are posted, the general ledger T-accounts would appear as follows:

- 50247 reads