Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

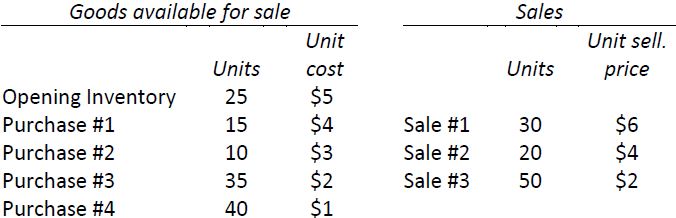

Western Produce Inc. uses the periodic inventory system. The following data are taken from the records of the company for the month of January 2018.

Required:

- Calculate the amount of inventory at the end of January assuming that inventory is cost is calculated using FIFO inventory cost flow assumption.

- How would the ending inventory differ if it was cost is calculated using weighted average?

- Calculate the amount of gross profit under each of the above costing methods. Which method matches inventory costs more closely with revenues? Why?

- Would more income tax be payable under the FIFO or weighted average method in a period of rising prices? Explain why.

- 1885 reads