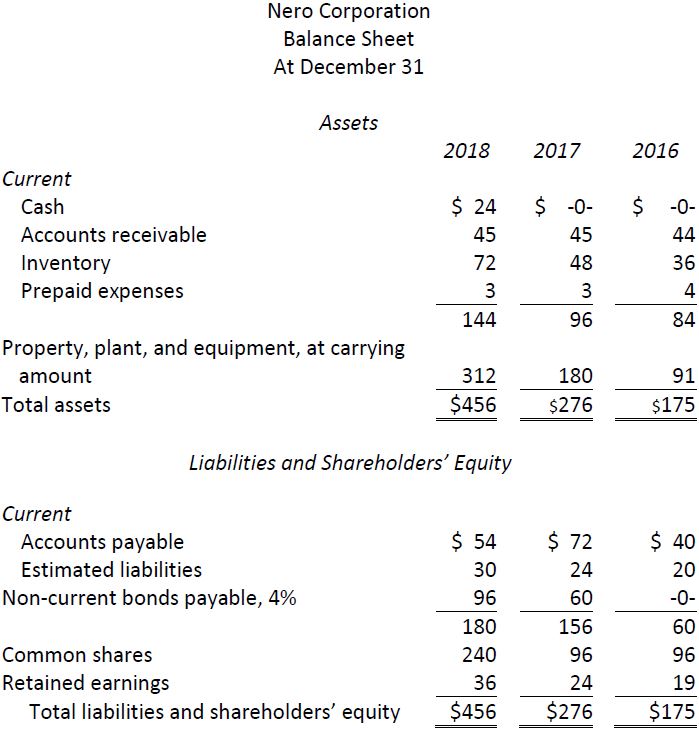

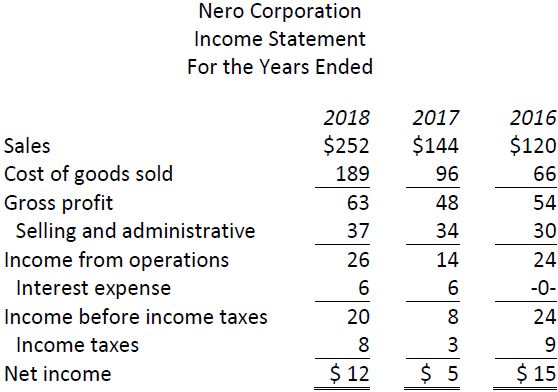

The following are condensed comparative financial statements of Nero Corporation for the three years ended December 31, 2016, 2017, and 2018.

The following additional information is available:

|

a. |

All sales are on credit; credit terms are net 60 days after invoice date. |

|

b. |

Twenty common shares were outstanding in years 2016 and 2017. On April 1, 2018, an additional 30 common shares were issued for $144 cash in total. |

|

c. |

The accounts receivable balance at January 1, 2016 was $19. |

|

d. |

The inventory balance at January 1, 2016 was $24. |

|

e. |

The net capital assets balance at January 1, 2016 was $91. |

|

f. |

The total assets balance at January 1, 2016 was $165. |

|

g. |

The total shareholders’ equity balance at January 1, 2016 was $101. |

|

h. |

Dividends of $8 were declared in 2016. No dividends were declared in 2017 and 2018. |

|

i. |

Interest has been paid on the bonds each year and is included in interest expense. |

|

Required: |

||||

|

1. |

From the above information, calculate the following for each of the three years: |

|||

|

a. |

Liquidity |

|||

|

Current ratio Acid-test ratio Accounts receivable collection period Number of days of sales in inventory Revenue operating cycle. |

||||

|

b. |

Profitability |

|||

|

Gross profit ratio Net profit ratio Return on total assets Return on shareholders’ equity |

||||

|

c. |

Leverage |

|||

|

Debt to shareholders’ equity ratio Times interest earned |

||||

|

d. |

Market measures |

|||

|

Earnings per share |

||||

|

2. |

What conclusions can be drawn? |

|||

|

3. |

(Appendix) Restate the financial statements for all three years to facilitate Scott formula analysis. |

|||

|

4. |

(Appendix) Calculate the Scott formula for the three years and comment on the results. |

|||

- 2541 reads