Tarpon Inc. made $1,000,000 in sales during 2016. Thirty per cent of these were cash sales. During the year, $25,000 of accounts receivable were written off as being uncollectible. In addition, $15,000 of the accounts that were written off in 2015 were unexpectedly collected. At its year-end, December 31, 2016, Tarpon had $250,000 of accounts receivable. The balance in the Allowance for Doubtful Accounts general ledger account was $15,000 credit at December 31, 2015.

Required:

- Prepare journal entries to record the following 2016 transactions:

- The write-off of $25,000

- The recovery of $15,000.

- Recalculate the balance in the Allowance for Doubtful Accounts general ledger account at December 31, 2016.

- Prepare the adjusting entry required at December 31, 2016 for each of the following scenarios:

- The estimated uncollectible accounts at December 31, 2016 is three per cent of credit sales.

- The estimated uncollectible accounts at December 31, 2016 is estimated at five per cent of accounts receivable.

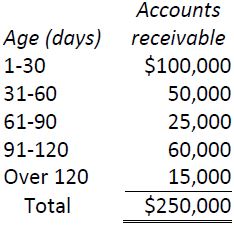

- The estimated uncollectible accounts at December 31, 2016 are calculated as follows:

|

Age (days) |

Estimated loss percentage |

|

1-30 |

2% |

|

31-60 |

4% |

|

61-90 |

5% |

|

91-120 |

10% |

|

Over 120 |

50% |

- 1918 reads