Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

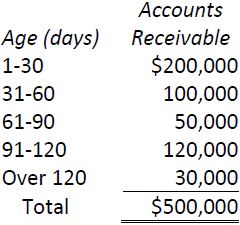

Zane Corp. had $2,000,000 in sales during 2017. Thirty per cent of these were cash sales. During the year, $50,000 of accounts receivable were written off as being uncollectible. In addition, $30,000 of the accounts that were written off in 2016 were unexpectedly collected. Accounts receivable at the year-end of Zane, December 31, 2017 amounted to $500,000, as shown below. The balance in the Allowance for Doubtful Accounts account was $30,000 credit at December 31, 2016.

Required:

- Prepare journal entries to record the following 2016 transactions:

- The write-off of $50,000

- The recovery of $30,000.

- Prepare an adjusting entry required at December 31, 2017 for each of the following scenarios:

- On the basis of experience, the uncollectible accounts at December 31, 2016 are estimated at 1% of credit sales.

- On the basis of experience, the uncollectible accounts at December 31, 2017 are estimated at 6% of accounts receivable.

- On the basis of experience, the estimated uncollectible accounts at December 31, 2017 are calculated as follows:

- 1754 reads