Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

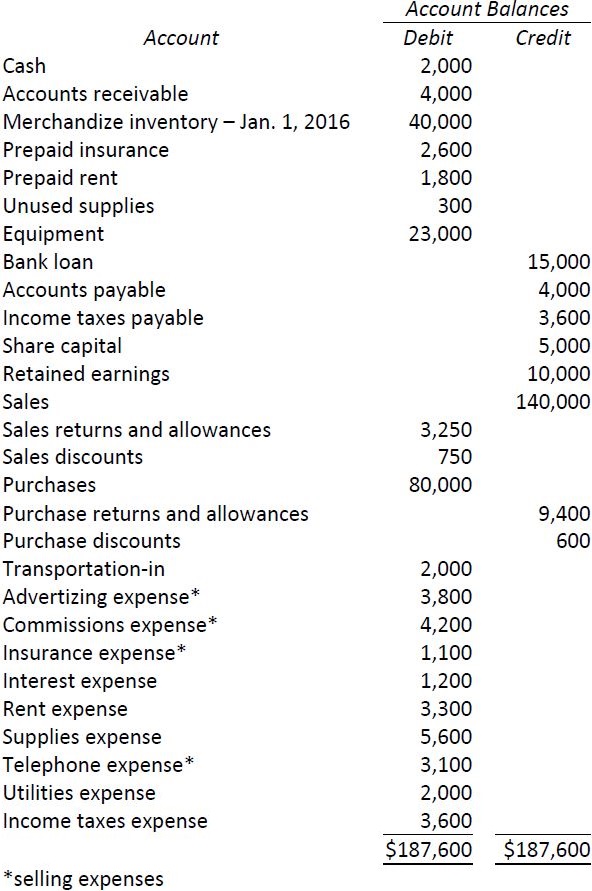

The following unadjusted trial balance has been extracted from the records of Niven Shops Inc. at December 31, 2017, its fiscal year‐end. The balances for share capital and retained earnings have not changed during the year.

Required:

- Prepare adjusting entries, including general ledger account numbers and a brief description for each entry, for the following:

- The balance in Prepaid Rent consists of equal amounts of rent for the months of December 2017, and January and February 2018.

- Interest on the bank loan applicable to the month of December amounts to $100 has not yet been recorded as Interest Payable.

- A December commission expense owing of $500 has not been recorded.

- The balance in Prepaid Insurance applies equally to each of the thirteen months ended December 31, 2018.

- A physical count of unused supplies indicated that there was $2,000 on hand at year-end.

- A physical count indicates that $35,000 of merchandize inventory is on hand at December 31, 2017.

- Prepare an adjusted trial balance at December 31, 2017.

- Prepare a classified income statement and statement of changes in equity for the year ended December 31, 2017, and a classified balance sheet at December 31.

- Prepare closing entries. Include general ledger account numbers and a brief description for each entry. Include general ledger account numbers and a brief description for each entry.

- 2417 reads