As a general rule, long-term financing should be used to finance long-term assets.

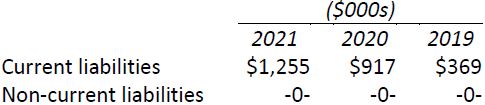

Note that in BDCC’s case, property, plant, and equipment assets amount to $1,053,000 at December 31, 2021 yet the firm has no long-term liabilities. This is unusual. An analysis of the company’s balance sheet reveals the following:

2021 information indicates that BDCC’s management relies solely on short-term creditor financing, part of which is $382,000 of accounts payable that may bear no interest and $825,000 of borrowings that also need to be repaid within one year. The risk is that management will likely need to replace current liabilities with new liabilities. If creditors become unwilling to do this, the ability of BDCC to pay its short-term creditors may be compromised. As a result, the company may experience a liquidity crisis —the inability to pay its current liabilities as they come due.

Even though a company may be earning net income each year (as in BDCC’s case), it may still be unable to pay its current liabilities as needed because of a shortage of cash:

Current liabilities

- Creditors can refuse to provide any further goods or services on account.

- Creditors can sue for payment.

- Creditors can put the company into receivership or bankruptcy.

Non-current liabilities

- Long-term creditors can refuse to lend additional cash.

- Creditors can demand repayment of their long-term debts, under some circumstances.

Shareholders’ equity

- Shareholders may be unwilling to invest in additional share capital of the company.

- Shareholders risk the loss of their investments if the company declares bankruptcy.

There are several ratios that can be used to analyze the liquidity of a company.

- 1549 reads