The gross profit ratio indicates the percentage of sales revenue that is left to pay operating expenses, creditor interest, and income taxes after deducting cost of goods sold. The ratio is calculated as:

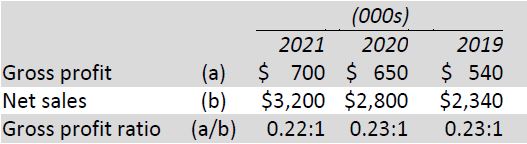

BDCC’s gross profit ratios for the three years are:

In other words, for each dollar of sales BDCC has $0.22 of gross profit left to cover operating, interest, and income tax expenses ($0.23 in each of 2020 and 2019). The ratio has not changed significantly from year to year. However, even a small decline in this percentage can affect net income significantly because the gross profit is such a large component of the income statement. Changes in the gross profit ratio should be investigated, as it will impact future financial performance.

- 2134 reads