Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

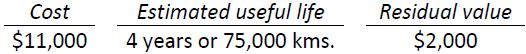

Roberto Trucks Inc. purchased a delivery van on January 1, 2016. Assume this was the company’s only capital asset and that the company uses the ½ year rule in the year of acquisition and disposal for straight-line and double-declining balance depreciation methods. The following information is available.

The truck was driven 20,000 km in 2016.

Required:

- Calculate the depreciation for 2016 under each of the following methods:

- Usage

- Straight-line

- Double-declining balance

- Compare the depreciation expense and carrying amount for 2016 under each of these methods.

- If one of management’s objectives is to maximize 2016 net income, what method should be adopted?

- 1763 reads