There are two components necessary to determine the inventory value disclosed on a corporation’s balance sheet. The first component involves calculating the quantity of inventory on hand at the end of an accounting period by performing a physical inventory count. The second requirement involves assigning the most appropriate cost to this quantity of inventory.

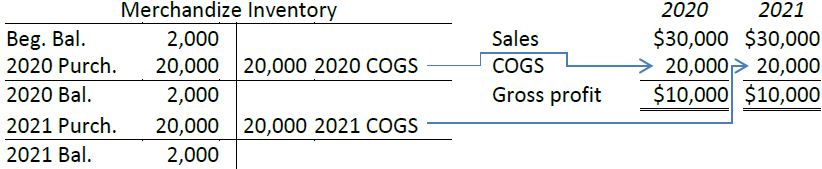

An error in calculating either the quantity or the cost of ending inventory will misstate reported income for two time periods. Assume merchandize inventory at December 31, 2019, 2020, and 2021 was reported as $2,000 and that merchandize purchases during each of 2020 and 2021 were $20,000. There were no other expenditures. Assume further that sales each year amounted to $30,000 with cost of goods sold of $20,000 resulting in gross profit of $10,000. These transactions are summarized below.

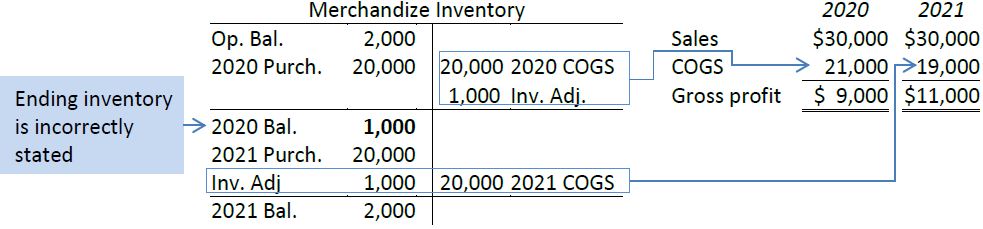

Assume now that ending inventory was misstated at December 31, 2020. Instead of the $2,000 that was reported, the correct value should have been $1,000. The effect of this error was to understate cost of goods sold on the income statement—cost of goods sold should have been $21,000 in 2020 as shown below instead of $20,000 as originally reported above. Because of the 2020 error, the 2021 beginning inventory was incorrectly reported above as $2,000 and should have been $1,000 as shown below. This caused the 2021 gross profit to be understated by $1,000—cost of goods sold in 2021 should have been $19,000 as illustrated below but was originally reported above as $20,000.

As can be seen, income is misstated in both 2020 and 2021 because cost of goods sold in both years is affected by the adjustment to ending inventory needed at the end of 2020 and 2021. The opposite effects occur when inventory is understated at the end of an accounting period.

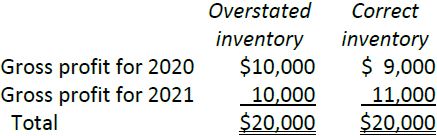

An error in ending inventory is offset in the next year because one year’s ending inventory becomes the next year’s opening inventory. This process can be illustrated by comparing gross profits for 2020 and 2021 in the above example. The sum of both years’ gross profits is the same.

- 8690 reads