| LO4 – Explain, calculate, and record revised depreciation for subsequent capital expenditures. |

Both the useful life and residual value of a depreciable asset are estimated at the time it is purchased. As time goes by, these estimates may change for a variety of reasons. In these cases, the depreciation expense is recalculated from the date of the change in the accounting estimate and applied going forward. No change is made to depreciationexpense already recorded.

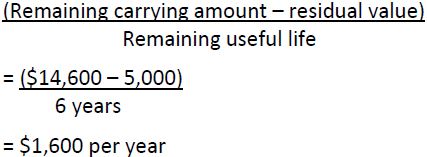

Consider the example of the equipment purchased for $20,000 on January 1, 2015, with an estimated useful life of five years and residual value of $2,000. If the straight-line depreciation method and the halfyear rule are used, the depreciation expense is $1,800 in 2015 and $3,600 in 2016. The carrying amount at the end of 2016 is $14,600 ($20,000 – 1,800 – 3,600). Assume that on December 31, 2017, management estimates the remaining useful life of the equipment to be six years, and the residual value to be $5,000.

Depreciation expense for the remaining six years would be calculated as:

- 2270 reads