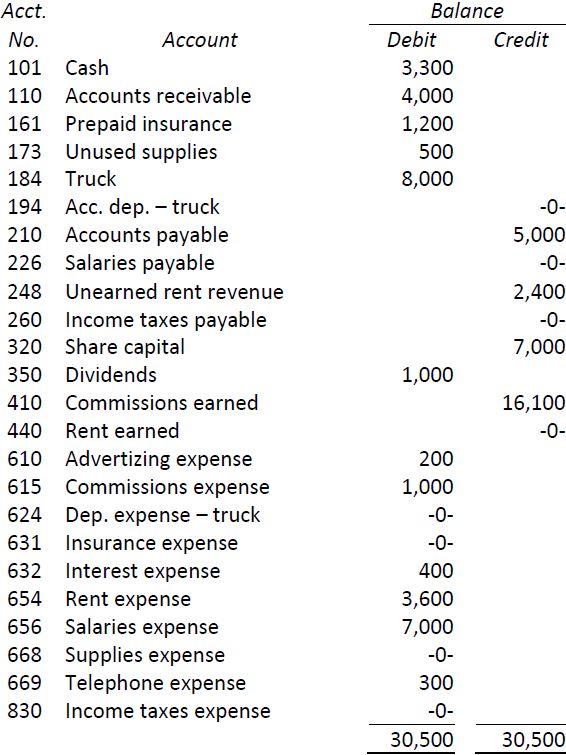

Following is the unadjusted trial balance of Pape Pens Corporation at the end of its first year of operations, December 31, 2016:

The following additional information is available:

|

a. |

Prepaid insurance at December 31 amounts to $600. |

|

b. |

A physical count indicates that $300 of supplies is still on hand at December 31. |

|

c. |

The truck was purchased on July 1; it has an estimated useful life of 4 years. |

|

d. |

One day of salaries for December 31 is unpaid; the unpaid amount of $200 will be included in the first Friday payment in January. |

|

e. |

The balance in the Unearned Rent Revenue account represents six months rental of warehouse space, effective October 1. |

|

f. |

A $100 bill for December telephone charges has not yet been recorded. |

|

g. |

Income taxes expense for the year is $300. This amount will be paid in the next fiscal year. |

Required:

- Prepare all necessary adjusting entries at December 31, 2016, including general ledger account numbers. Descriptions are not needed.

- Prepare an adjusted trial balance at December 31, 2016.

- Prepare an income statement, statement of changes in equity, and balance sheet.

- Prepare closing entries including general ledger account numbers and descriptions.

- Prepare a post‐closing trial balance.

- 2332 reads