The opening inventory of Tan Corporation at January 1, 2018 consisted of 50 units at $1 each. The company uses the periodic inventory system. The following purchases were made during 2018.

|

Units |

Unit Cost |

||

|

Apr. |

15 |

200 |

$2 |

|

May |

25 |

200 |

$3 |

|

June |

7 |

200 |

$4 |

|

Oct. |

15 |

200 |

$5 |

|

Required: |

|

|

1. |

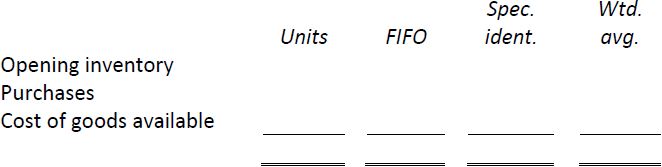

Calculate the number of units available for sale. Then calculate the dollar amount of cost of goods available for sale at December 31, 2018. Set up a column for each of FIFO, specific identification, and weighted average inventory cost flow assumptions as follows: |

|

|

|

2. |

If there are 200 units on hand at December 31, 2018, calculate the cost of ending inventory under each of FIFO, specific identification, and weighted average inventory cost flow assumptions. . For specific identification purposes, items sold were: |

|

50 units of the April 15 purchases 200 units of the May 25 purchases 200 units of the June 7 purchases 200 units of the October 15 purchases |

|

|

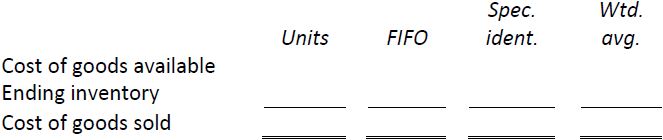

3. |

Calculate the cost of goods sold under each of FIFO, specific identification, and weighted average inventory cost flow assumptions. Set up a table as follows: |

|

|

|

4. |

Based on the calculations in (3), the president of Tan Corporation has asked you to prepare some calculations comparing the effect on income of a. Using a weighted average cost flow method instead of specific identification; b. Using a FIFO cost flow method instead of specific identification. |

|

5. |

What method of cost flow would you recommend in this case? Why? |

- 1903 reads