Available under Creative Commons-NonCommercial-ShareAlike 4.0 International License.

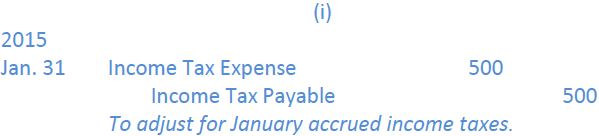

Corporate income taxes expense also needs to be accrued for BDCC. In most jurisdictions, a corporation is taxed as an entity separate from its shareholders. For simplicity, assume BDCC’s income tax expense for January 2015 is $500 and that this amount will be paid after the company’s year-end, December 31. The adjusting entry for January is:

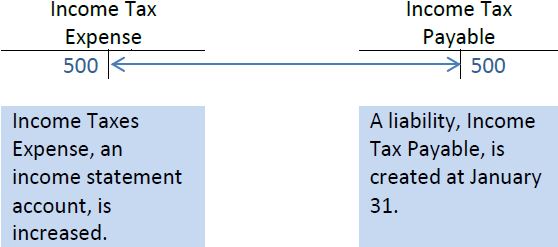

When the adjusting entry is posted, the accounts appear as follows:

This adjusting entry enables the company to match the income tax expense accrued in January to the income earned during the same month.

- 2379 reads