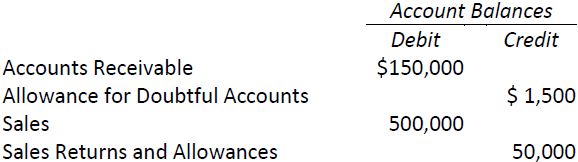

The following balances are taken from the unadjusted trial balance of Penner Inc. at its year-end, December 31, 2015.

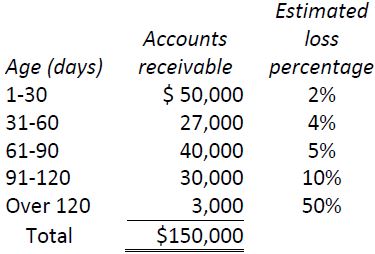

An ageing of accounts receivable at December 31, 2015 reveals the following information:

The balance for R. Laws of $1,000 is over 90 days past due. It is included in the ageing of accounts receivable balance and has not yet been written off.

Part A: 2015

Required: Prepare journal entries to record:

- The write-off of R. Laws’ account of $1,000 on December 31, 2015. (Hint: Recalculate the accounts receivable balance after the writeoff.)

- The appropriate adjusting entry to set up the required balance in the Allowance for Doubtful Accounts general ledger account at December 31, 2015. (Hint: Remember that R. Laws’ account has been written off.)

Part B: 2016

The following transactions were made in 2016.

|

a. |

Sales on account were $700,000. |

|

b. |

Collections of accounts receivable amounted to $599,000. |

|

c. |

Penner wrote off $10,000 of accounts receivable. |

|

d. |

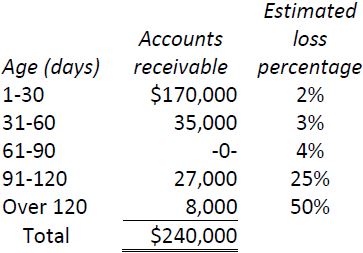

An ageing of accounts receivable at December 31, 2016 revealed the following information: |

Required: Prepare the appropriate adjusting entry to set up the required Allowance for Doubtful Accounts general ledger account balance at December 31, 2016.

- 1902 reads