Measures of efficiency can focus on shareholder returns on a per-share basis. That is, the amount of net income earned in a year can be divided by the number of common shares outstanding to establish how much return has been earned for each outstanding share. This earnings-per-share (EPS) value is calculated as:

EPS is quoted in financial markets and is disclosed on the income statement of publicly-traded companies. If there are preferred shareholders, they have first rights to distribution of dividends. Therefore, when calculating EPS, preferred shareholders’ claims on net income are deducted from net income to calculate the amount available for common shareholders:

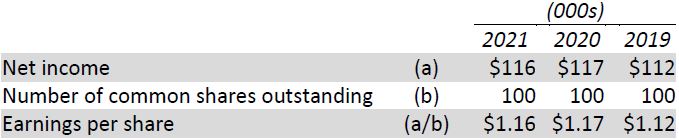

BDCC has no preferred shares and thus no preferred share dividends. Recall that 100,000 common shares are outstanding at the end of 2019, 2020, and 2021.

For BDCC, EPS calculations for the three years are:

Big Dog’s EPS has remained relatively constant over the three-year period because both net income and number of outstanding shares have remained fairly stable. Increasing sales levels and the resulting positive effects on net income, combined with unchanged common shares issued, has generally accounted for the slight increase from 2019 to 2020.

- 1896 reads