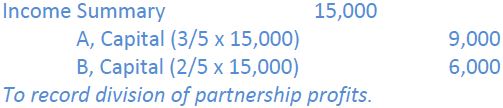

The division of profits and losses according to a fixed ratio is appropriate when each partner makes an equal contribution to the business. Ideally, each partner would have an equal amount of capital invested in the partnership and would devote an equal amount of time and effort in the business. However, usually the amount of capital differs, and time and effort devoted to the business is unequal. The initial calculation of a fixed ratio inclusion in the partnership agreement considers these factors. Partners can agree to share profits in any manner – for example, in a fixed ratio, such as 3:2. A ratio of ‘3:2’ means that 60 per cent (3/5) of the partnership income is allocated to partner A and 40 per cent (2/5) is allocated to Partner B. Assuming that A and B share profits in the ratio of 3:2, a $15,000 profit would be divided and recorded by the following entry:

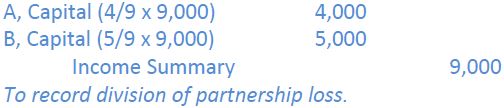

Partnership losses are allocated in the same manner. Assume that partners A and B share profits and losses at a fixed ration of 4:5. In this case, a $9,000 loss would be divided as follows:

- 3608 reads