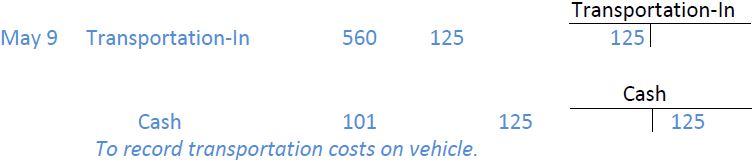

Under the perpetual inventory system, the cost of transporting the vehicle to Excel’s premises was added to the Merchandize Inventory account on the balance sheet. Under the periodic inventory system, a Transportation-in account is used to accumulate freight charges on merchandize purchased for re-sale. Like the Purchases and Purchase discounts accounts, this is also an income statement account which is used to calculate cost of goods sold directly on the income statement.

Recall the cost of shipping the vehicle is $125 and it is paid in cash to the truck driver. Payment would be recorded as follows:

The vehicle is then sold for $3,000 on May 15. A $100 allowance is granted for damage to the vehicle during delivery. A $58 sales discount is granted because the customer paid the balance owing to Excel within the discount period. The sales transactions are recorded in the same manner under both the perpetual and periodic inventory systems.

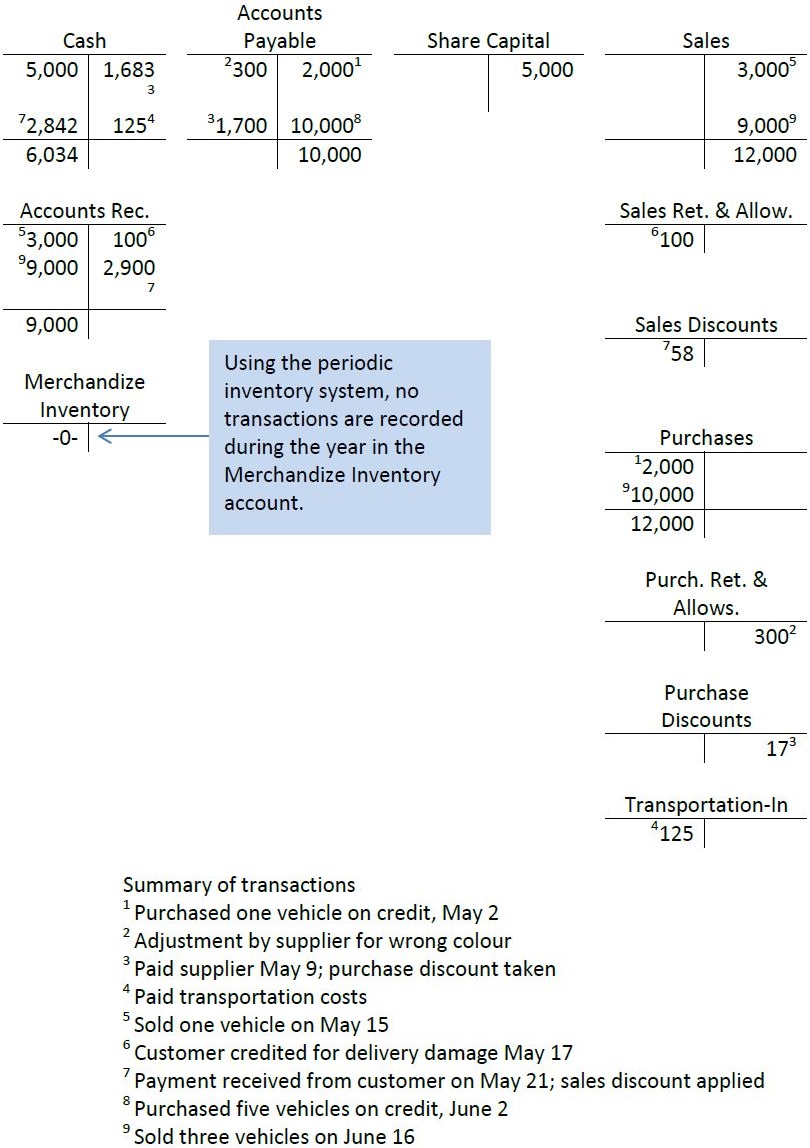

The summary of these transactions is:

Note, however, that there is no entry made to adjust Merchandize Inventory and cost of goods sold when recording the May 15 sales. This is different from the perpetual inventory system. There have been no entries made to the Merchandize Inventory account to date using the periodic inventory system.

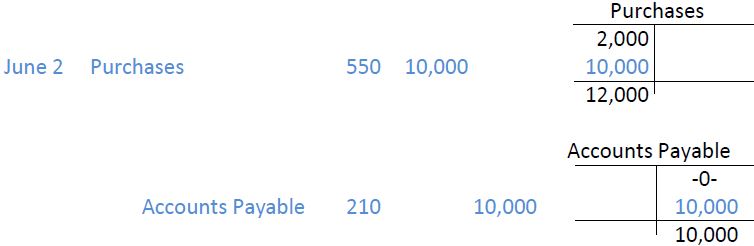

The same transactions also occur in June as described earlier. Five vehicles are purchased for $2,000 each, or $10,000 in total. The entry to record the purchase of the vehicles is:

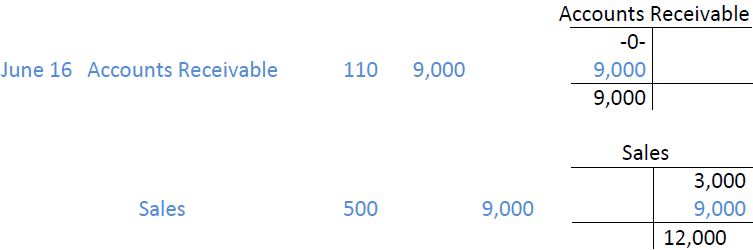

Three vehicles are sold during June for $3,000 each, or $9,000 in total. The entry to record the sale of the vehicles is:

Again, note that there are no adjustments to the Merchandize Inventory or Cost of Goods Sold accounts in the general ledger at this point, unlike the perpetual inventory system. After the June transactions are recorded, the general ledger T-accounts would appear as follows:

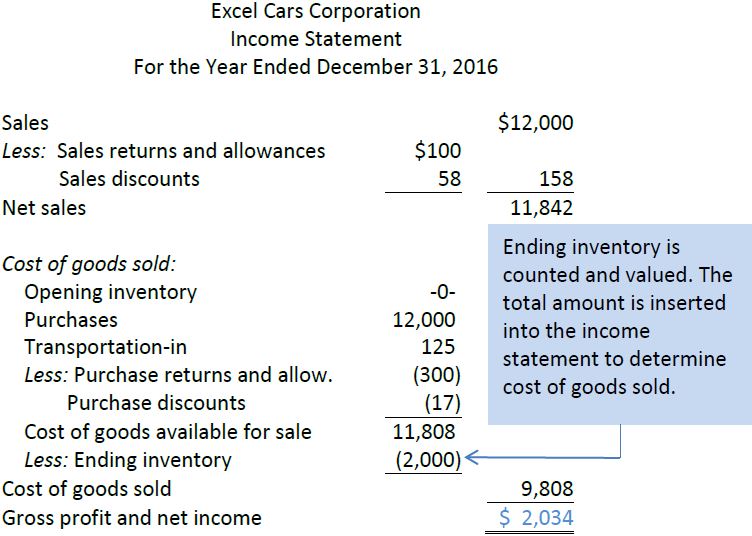

Assume again that no other transactions occur during the year. When financial statements are prepared at December 31, a physical count of inventory is taken. Purchase invoices are referenced to determine the value of the items counted. The resulting amount is inserted into the income statement to determine the cost of goods sold for the year.

In the case of Excel, a physical count should show that there is one vehicle left on the lot. Referring to the purchase documents, this vehicle would be valued at its purchase price - $2,000. The value of ending inventory would thus be calculated as $2,000. This information is inserted directly into the income statement of Excel for the year ended December 31, 2016. Combined with the information in the general ledger T-accounts, the income statement would show:

Net income remains the same under either the perpetual or periodic inventory system ($2,034). The periodic method is simpler to use than the perpetual inventory system, and is often used by small businesses because the costs of inventory recordkeeping are reduced. However, a perpetual inventory system enables management to compare inventory records to actual goods on hand at a period end to determine if any shrinkage has occurred, for instance. This security feature is not present with the periodic inventory system. The extra costs of recordkeeping using a perpetual inventory system are offset by the added control over a high-value asset like inventory, especially when there are thousands of items that a business may buy for re-sale each year and where shrinkage can be a significant issue.

- 5267 reads