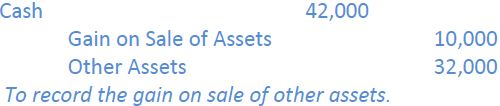

Each partner’s share of gains realized on the sale of assets is recorded as an increase in his/her capital account. If the other assets are sold for $42,000, the following entry is prepared to record the gain.

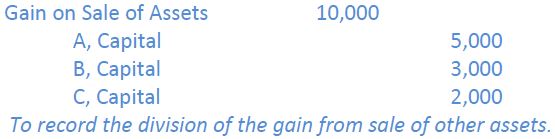

The $10,000 gain is then divided among the partners in their 5:3:2 profit and loss sharing ratio:

The liabilities are then paid; the journal entry to record the payment follows.

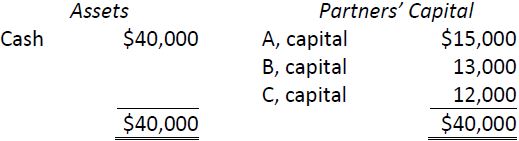

At this point, the balance sheet would show:

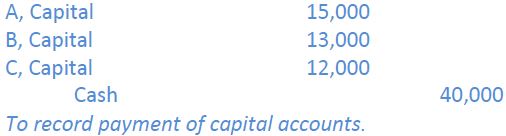

The following entry is prepared to record payment of the three capital account balances and complete the liquidation of the partnership:

Note that all capital account balances are zero following the distribution of cash.

- 2197 reads