| LO7 – Explain and record restrictions on retained earnings. |

Retained earnings represent the net income earned by a company over its life that has not been distributed as dividends to shareholders.

Retained earnings can be either restricted or unrestricted with respect to dividend distributions, as follows:

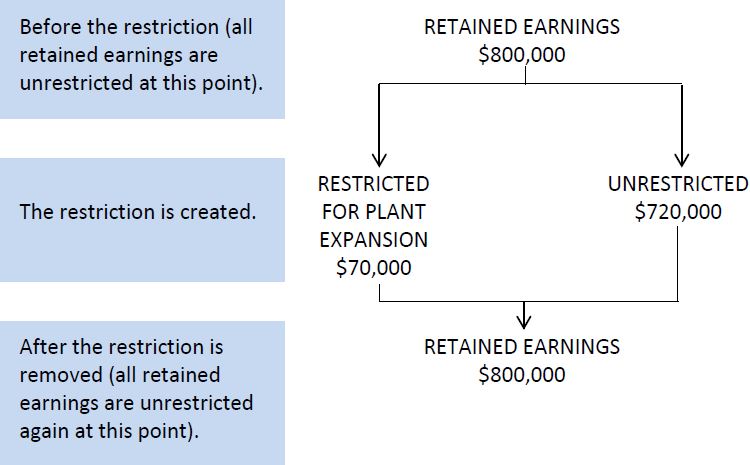

Assume that New World Corporation has retained earnings of $800,000 at December 31, 2018. The board of directors passes a resolution at the 2018 year-end to restrict $70,000 of retained earnings for a plant expansion. The full cycle of the restriction within retained earnings is shown in Figure 11.7.

As can be seen, the creation of a restriction on retained earnings divides the $800,000 amount into a restricted component of $70,000 and an unrestricted component of $720,000.

The creation of a restriction on retained earnings indicates management’s intention to use assets for a particular purpose. It is reported on the financial statements so that investors and creditors are informed that these assets are unavailable for dividends. These restrictions do not in any way alter the total amount of retained earnings or shareholders’ equity.

The journal entry to record the creation of the above $70,000 restriction for plant expansion would be:

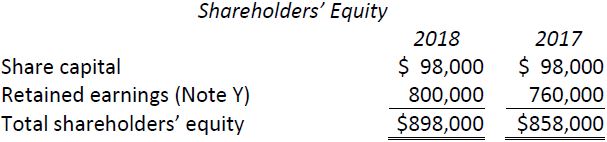

This restriction records a portion of these earnings in an account specifically designated to indicate its purpose—plant expansion. The restricted amount is still part of retained earnings. It is classified as retained earnings in the shareholders’ equity section of the balance sheet at December 31, 2018 as follows:

The relevant note to the financial statements would state:

Note Y

On December 31, 2018 the board of directors authorized a $70,000 restriction on the retained earnings of the company for plant expansion.

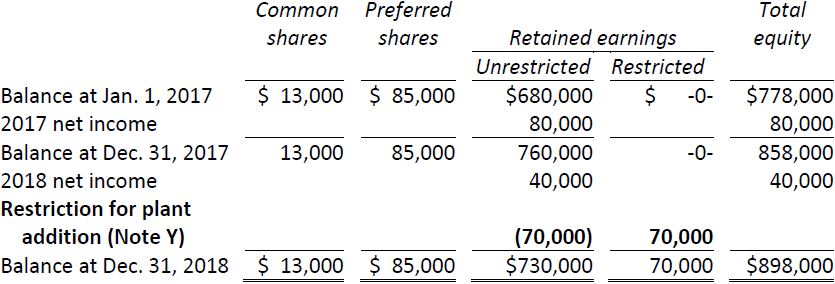

The statement of changes in equity would show (bolded for illustrative purposes):

It is important to understand that recording a restriction for plant expansion does not set up some kind of cash fund for the expansion. It merely ensures that investors are aware that all the retained earnings of the corporation are not eligible to be paid out as dividends while the restriction is in place and that the assets represented by the restriction will be used for another purpose in the meantime.

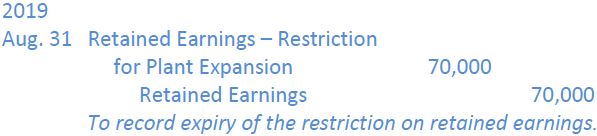

When the special restriction account has served its purpose and the requirement for which it was set up no longer exists, the amount in the restriction account is returned to the retained earnings account from which it was created. The entry setting up the restriction is reversed. The construction of the plant is recorded in the normal manner.

Assume that the plant expansion costs $70,000 and is paid in cash on August 31, 2019. The construction and payment is recorded as follows.

This journal entry records the actual plant expenditure. It also shows that restricted retained earnings are not used to pay for the plant. The expenditure is paid with the asset cash. At August 31, 2019, the entry to reverse the original journal entry and eliminate the restricted amount for plant expansion is made:

The restriction account is reversed when the plant has been built because dividends are no longer restricted by the need for a plant expansion.

- 6607 reads