Another contra revenue account, Sales Discounts, records reductions in sales amounts when a customer pays within a certain time period. For example, assume Excel Cars Corporation offers sales terms of “2/10, n30.” This means that the amount owed must be paid by the customer within 30 days (‘n’ = net); however, if the customer chooses to pay within 10 days, a 2% discount may be deducted from the amount owing.

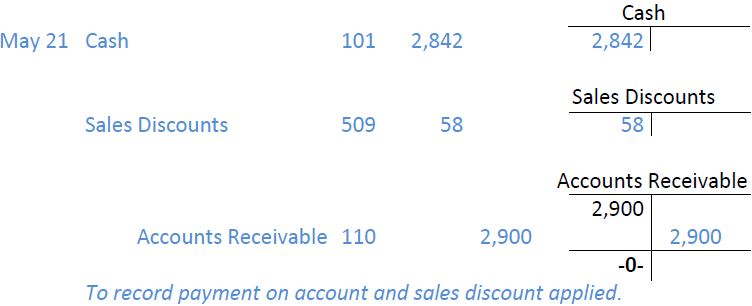

Consider the sale of the vehicle for $2,900 ($3,000 less the $100 allowance for damage). Payment within 10 days entitles the customer to a $58 discount ($2,900 x 2% = $58). If payment is made on May 21 and therefore within the discount period, Excel receives $2,842 cash ($2,900 - 58) and prepares the following entry:

This entry reduces the accounts receivable amount to zero which is the desired result. If payment is not made within the discount period, the customer pays the full amount owing of $2,900.

The Sales Allowances and Sales Discounts contra accounts are deducted from sales on the income statement to arrive at net sales. Cost of goods sold is deducted from net sales. If Excel purchased and sold only this one vehicle, the partial income statement for the period from January 1 to May 31 would show:

As was the case for Sales Returns and Allowances, the balance in the Sales Discounts account is deducted from Sales on the income statement to arrive at Net Sales. Merchandizers often report only the net sales amount on the income statement. Details from sales returns and allowances, and sales discounts, are often omitted because they are immaterial in amount relative to total sales. However, separate general ledger accounts for each of sales returns and allowances, and sales discounts, are useful in helping management identify potential problems that require investigation.

- 5129 reads