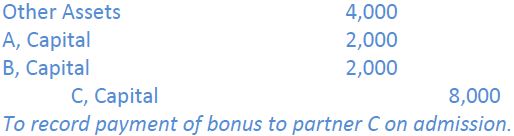

Assume instead that C invests assets at their fair value of $4,000 into the partnership for a one-third ownership interest. The new total capital amounts to $24,000 ($10,000 + 10,000 + 4,000); of this amount, $8,000 ($24,000 x 1/3) belongs to C. In this case, an equal amount of capital must be contributed by A and B to C to make up the difference between what C contributes and C’s capital balance. A bonus is used to accomplish this. Assuming that A and B share profits equally, the new partner’s entry is recorded as follows:

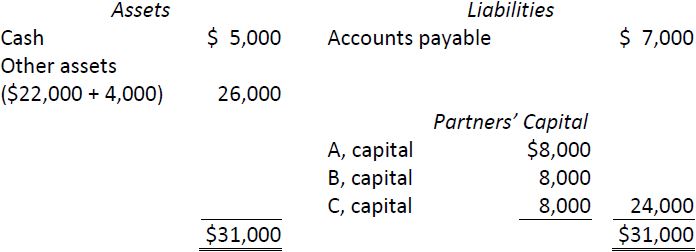

The partnership balance sheet following the recording of C’s investment would appear as follows:

- 2205 reads