There is one adjusting entry that may need to be made at year-end related to merchandize inventory. Usually, a physical count of inventory is conducted at the fiscal year-end. Costs are attached to these items and all are totalled. This total is then compared to the Merchandize Inventory account balance. These should agree, unless inventory has been lost for some reason. This discrepancy is called shrinkage. Theft and deterioration of goods held for re-sale are the most common examples of shrinkage.

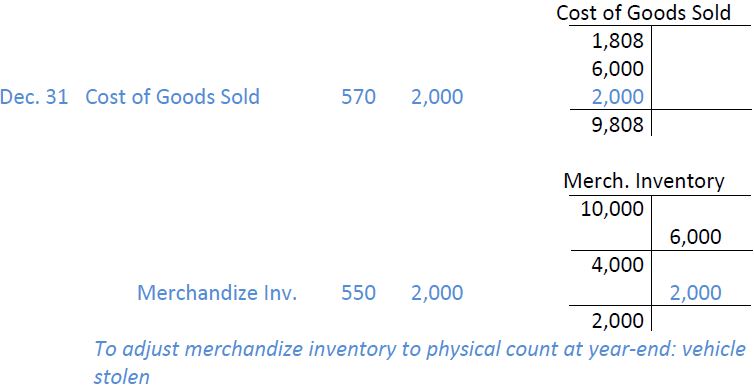

Assume that one of the two vehicles remaining on Excel’s vehicle lot is stolen prior to the year-end and that this has (somehow) gone unnoticed by staff. A physical count at December 31 would reveal one vehicle on hand. This vehicle would be traced to the related purchase invoice and valued at $2,000. Comparing this amount to the balance in the Merchandize Inventory account would reveal a discrepancy of $2,000 ($4,000 – 2,000), and the theft would be revealed. This ability to compare accounting records with actual items on hand can be a valuable means for management to safeguard assets of the company, as it alerts managers to possible shrinkage problems.

At the year-end, this shrinkage must be reflected in the accounting records. The following adjusting entry would be made:

Generally, shrinkage is recorded as part of cost of goods sold. If the amounts are abnormally large, however, a separate general ledger account can be maintained called, say, Inventory Shrinkage. The amount is still combined with cost of goods sold and not disclosed separately on the income statement, as it is considered information to be used only internally (to spur investment in the protection of physical inventory, for instance).

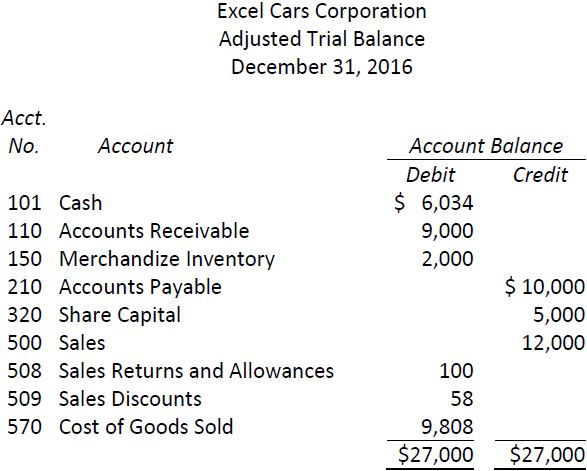

As there are no more adjustments at year-end in this example, an adjusted trial balance is prepared, as follows:

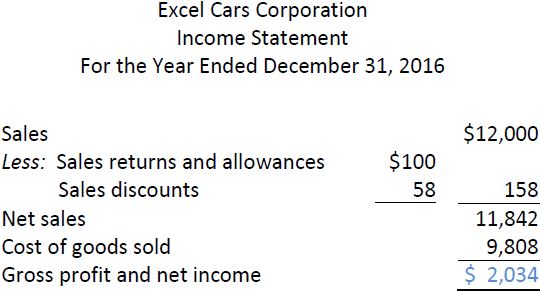

The financial statements for the year ended December 31 would be prepared from this information, as follows:

In this case, sales consists of four vehicles sold for $3,000 each, or $12,000 in total. Cost of goods sold of $9,808 consists of four vehicles that were originally purchased for $2,000 each, or $8,000 in total, plus transportation costs of $125 and the loss of one vehicle, less a purchase allowance of $300, a purchase discount of $17 related to the May sale, ($8,000 + 125 +2,000 – 300 – 17 = $9,808). Gross profit therefore equals $2,034. Since there are no other expenses, net income is the same amount.

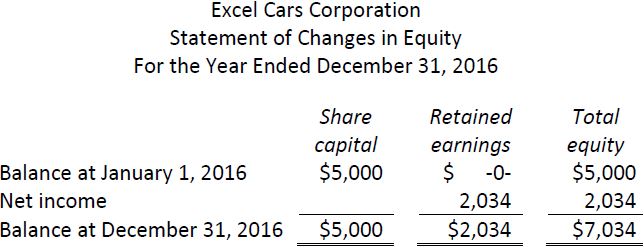

The statement of changes in equity would show:

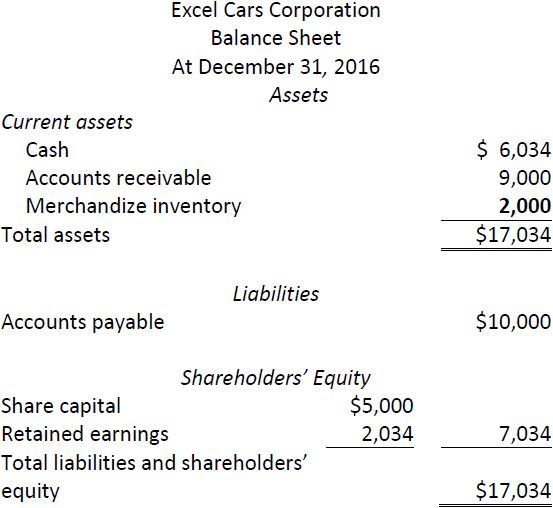

The balance sheet at year-end would show:

The one vehicle remaining in inventory at December 31 is valued at $2,000. This is the amount that remains in the Merchandize Inventory general ledger account, verified by physical count at year-end. It is appropriately shown as an asset on the balance sheet at December 31.

- 3422 reads