Like a proprietorship, the income statement of a partnership or proprietorship is similar to that of a corporation, except that there is no income taxes expense. Income taxes are paid personally by partners on all sources of income, including their amounts of partnership income allocated each year. A partnership income statement also does not record any salaries expense paid to partners. “Salaries” consist of the allocation of net income or loss each year to the respective partner, as described above.

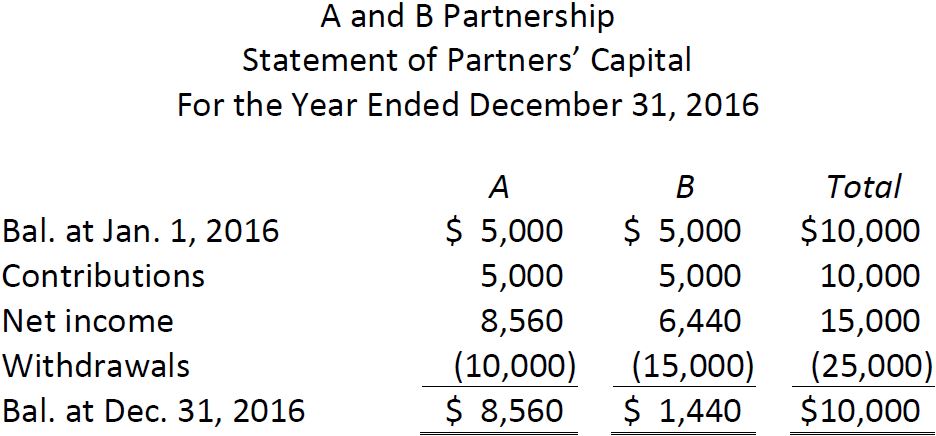

Similar to a proprietorship’s statement of equity, a statement of partners’ capital shows each partner’s contributions to the business, net income (or loss) allocations, and withdrawals during the year.

Assume that for the year ended December 31, 2016, partners A and B each had opening capital balances of $10,000. Each contributed $5,000 to the partnership during the fiscal year. Net income for the year equalled $15,000, allocated as A: $8,560; B: 6,400. Partner A withdrew $10,000 during the year; partner B withdrew $15,000. The statement of partners’ capital for A and B Partnership would appear as follows:

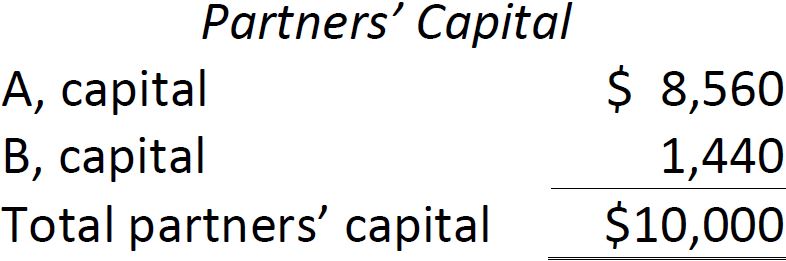

The balance sheet of a partnership can show the equity of each partner if there are only a few. For instance, the partners’ capital section of A and B Partnership could appear as follows on the balance sheet:

If there are many partners, only a total capital amount could be shown ($10,000 in this case), with details of each partner’s capital account disclosed in the statement of partners’ capital.

- 11020 reads