When a PPE asset is sold or has reached the end of its useful life, the asset’s cost and accumulated depreciation must be removed from the records, after depreciation expense has been recorded up to the date of disposal.

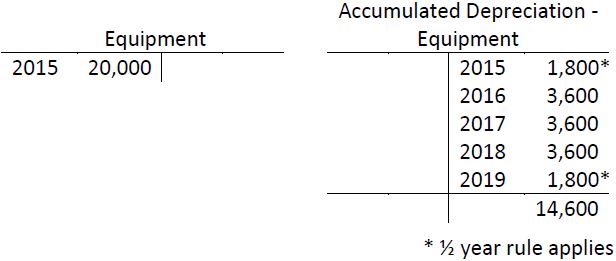

Recall the calculation of straight-line depreciation for the equipment purchased for $20,000 with an estimated useful life of five years and a residual value of $2,000. Assume that the equipment is sold on November 30, 2019. First, depreciation would be calculated to the date of disposal. The ½ year rule applies, so the depreciation expense would be $1,800 in 2019 ($3,600 x ½). After this entry is posted, the general ledger T-accounts at December 31, 2019 for Equipment and Accumulated Depreciation would show the following entries:

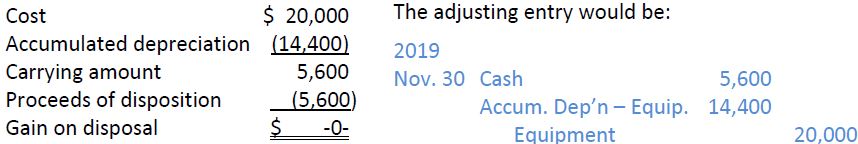

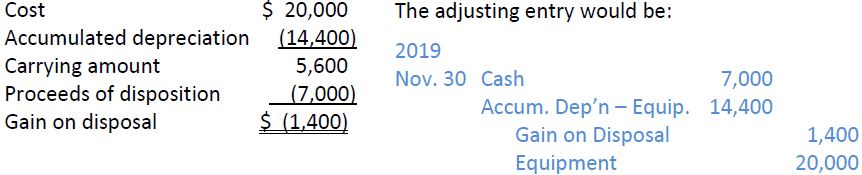

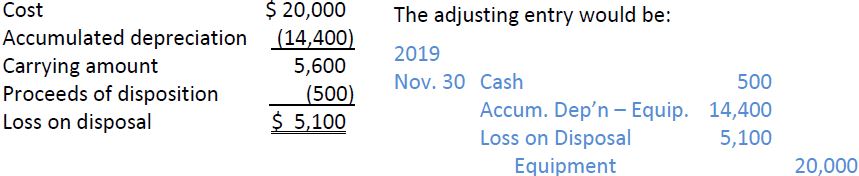

The carrying amount at this date is $5,600 ($20,000 cost – 14,400 accumulated depreciation). Three different situations are possible.

|

1. |

Sale at carrying amount

Assume the equipment is sold for its carrying amount of $5,600. No gain or loss on disposal would occur. |

|

2. |

Sale above carrying amount

Assume the equipment is sold for $7,000. A gain of $1,400 would occur. |

|

3. |

Sale below carrying amount

Assume the equipment is sold for $500. A loss on disposal of $5,100 would occur. |

In each of these cases, the cash proceeds must be recorded (by a debit) and the cost and accumulated depreciation must be removed from the accounts. A credit difference represents a gain on disposal while a debit difference represents a loss.

- 9775 reads