| LO2 – Explain the impact on financial statements of inventory cost flows and errors. |

When purchase costs are increasing, as in a period of inflation (or decreasing, as in a period of deflation), each cost flow assumption results in a different value for cost of goods sold and the resulting ending inventory, gross profit, and net income.

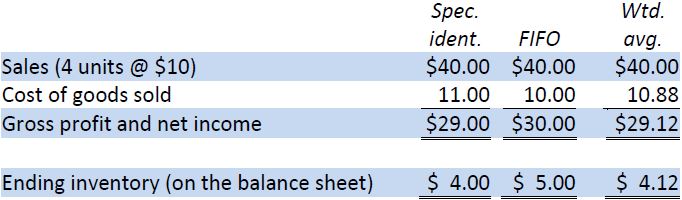

Using information from the preceding comprehensive example, the effects of each cost flow assumption on net income and ending inventory for the month are shown in Figure 6.11.

FIFO maximizes net income and ending inventory amounts when costs are rising. FIFO minimizes net income and ending inventory amounts when purchase costs are decreasing.

Because different cost flow assumptions can affect the financial statements, GAAP requires that the assumption adopted by a company be disclosed in its financial statements (full disclosure principle). Additionally, GAAP requires that once a method is adopted, it be used every accounting period thereafter (consistency principle) unless there is a justifiable reason to change. A business that has a variety of inventory items may choose a different cost flow assumption for each item. For example, Wal-Mart might use weighted average to account for its sporting goods items and specific identification for each of its various major appliances.

- 5967 reads