An asset or liability account requiring adjustment at the end of an accounting period is referred to as a mixed account because it includes both a balance sheet portion and an income statement portion. The income statement portion must be removed from the balance sheet account by an adjusting entry.

Refer to Figure 3.4 which shows an unadjusted balance in prepaid insurance of $2,400. Recall from Chapter 2 that Big Dog paid for a 12- month insurance policy that went into effect on January 1 (transaction 5).

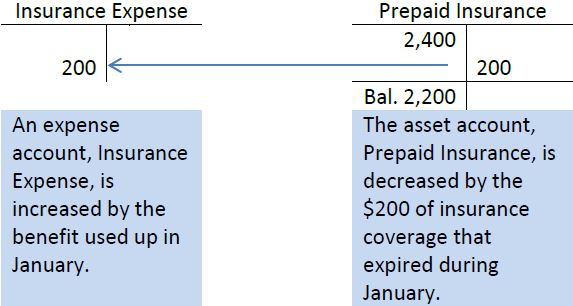

At January 31, one month or $200 of the policy has expired (been used up) calculated as $2,400/12 months = $200.

The adjusting entry on January 31 to transfer $200 out of prepaid insurance and into insurance expense is:

As shown below, the balance remaining in the Prepaid Insurance account is $2,200 after the adjusting entry is posted. The $2,200 balance represents the unexpired asset that will benefit future periods, namely, the 11 months from February to December, 2015. The $200 transferred out of prepaid insurance is posted as a debit to the Insurance Expense account to show how much insurance has been used during January.

If the adjustment was not recorded, assets on the balance sheet would be overstated by $200 and expenses would be understated by the same amount on the income statement.

- 2322 reads