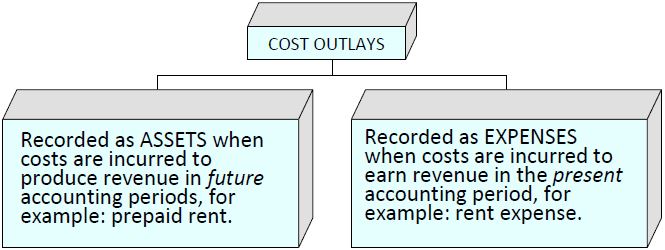

In a business, costs are incurred continuously. To review, a cost is recorded as an asset if it will be incurred in producing revenue in future accounting periods. A cost is recorded as an expense if it will be used or consumed during the current period to earn revenue. This distinction between types of cost outlays is illustrated in Figure 3.3.

In the previous section regarding revenue recognition, journal entries illustrated three scenarios where revenue was recognized before, at the same time as, and after cash was received. Similarly, expenses can be incurred before, at the same time as, or after cash is paid out. An example of when expenses are incurred before cash is paid occurs when the utilities expense for January is not paid until February. In this case, an account payable is created in January as follows:

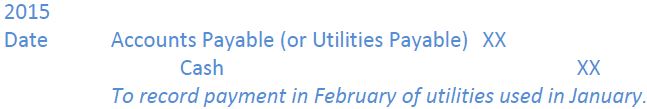

The utilities expense is appropriately reported in the January income statement. When the January utilities are paid with cash in February, the following is recorded:

This entry has no effect on expenses reported on the February income statement, since these were reported on the January income statement.

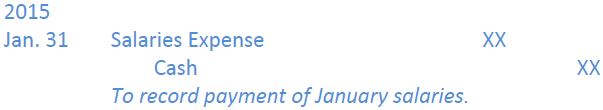

Expenses can also be recorded at the same time that cash is paid. For example, if salaries for January are paid on January 31, the entry on January 31 is:

As a result of this entry, salaries expense is reported on the January income statement when cash is paid. Transaction 9 in Chapter 2 illustrated these two options.

Finally, a cash payment can be made before the expense is incurred, such as insurance paid in advance. A prepayment of insurance creates an asset Prepaid Insurance and is recorded as:

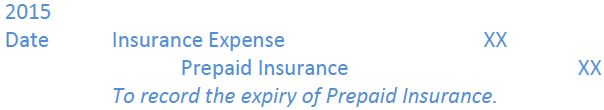

Transaction 5 in Chapter 2 illustrated this. As the prepaid insurance benefit is used up, the appropriate expense is reported on the income statement by following entry:

The preceding examples illustrate how to match expenses to the appropriate accounting period. The matching principle requires that expenses be reported in the same period as the revenues they helped generate. That is, expenses are reported on the income statement: a) when related revenue is recognized, or b) during the appropriate time period, regardless of when cash is paid.

To ensure the recognition and matching of revenues and expenses to the correct accounting period, account balances must be reviewed and adjusted prior to the preparation of financial statements. This is the topic of the next section.

- 2431 reads