The purchase of land is a capital expenditure when the land is used in the operation of a business. In addition to the costs listed in the schedule above, the cost of land should be increased by the cost of removing any unwanted structures on it. This cost is reduced by the proceeds, if any, obtained from the sale of the scrap. For example, assume that the purchase price of land is $100,000 before an additional $15,000 cost to raze an old building: $1,000 is expected to be received for salvaged materials. The cost of the land is calculated as $114,000 ($100,000 + $15,000 - $1,000).

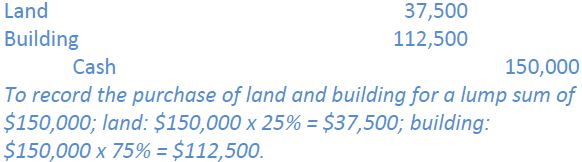

Frequently, land and useful buildings are purchased for a lump sum. That is, one price is negotiated for their entire purchase. A lump sum purchase price must be apportioned between the PPE assets acquired on the basis of their respective market values, perhaps established by a municipal assessment or a professional land appraiser. Assume that a lump sum of $150,000 cash is paid for land and a building, and that the land is appraised at 25% of the total purchase price. The Land account would be debited for $37,500 ($150,000 x 25%) and the Building account would be debited for the remaining 75% or $112,500 ($150,000 x 75% = $112,500 or $150,000 - $37,500 = $112,500) as shown in the following journal entry.

- 2241 reads