| LO4 – Record adjustments to merchandize inventory. |

In the simple example above, Excel did not have any merchandize inventory on hand at either the start of the year or at the end of May. It purchased and sold one vehicle during the month.

Now assume that Excel Cars Corporation purchased five vehicles from its supplier for $2,000 each on June 2, 2016. The company sold three of these for $3,000 each on June 16. On June 30, ending inventory would consist of two vehicles valued at $2,000 each, or $4,000 in total. (Note that inventory is valued at cost, not estimated selling price.) Assume there are no applicable transportation, purchase allowances or discounts expenditures.

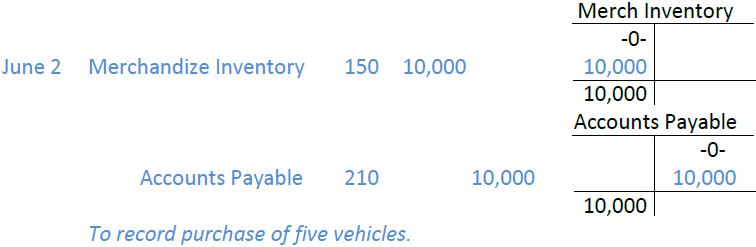

The journal entry to record the purchase of the vehicles on June 2 would be:

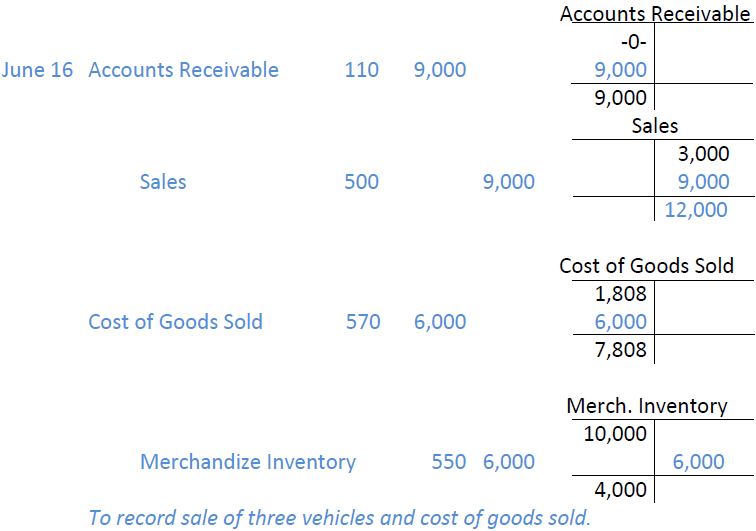

The summary journal entry to record the sale of the vehicles on June 16 would be:

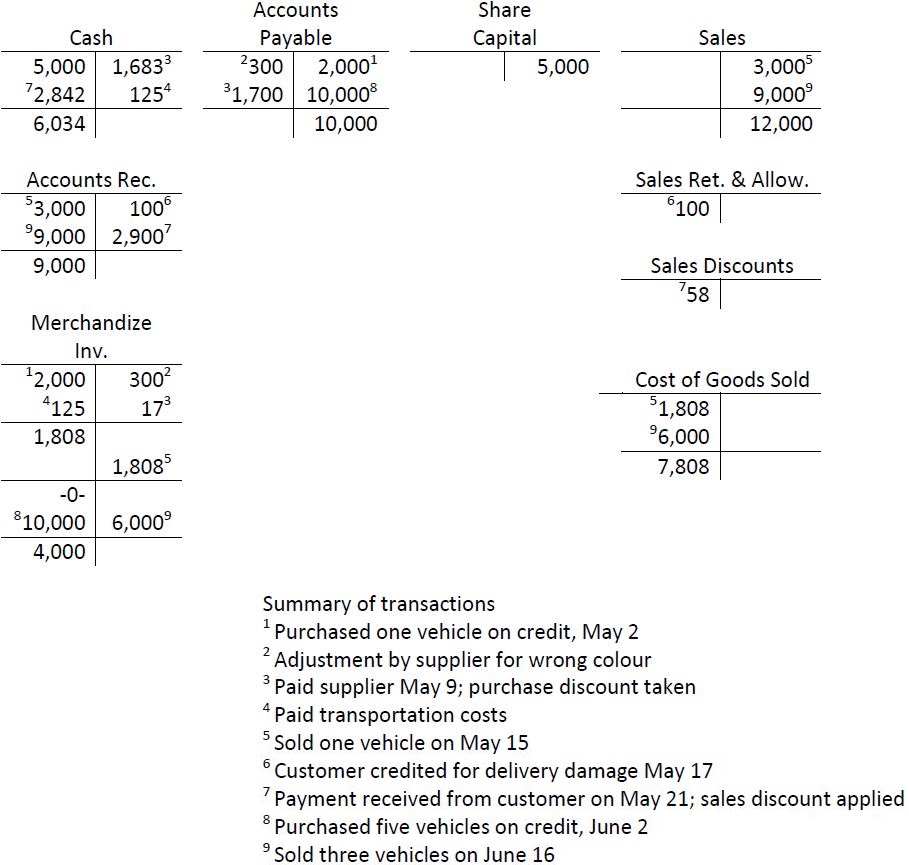

Assume the purchases and sales of vehicles in May and June were the only activity of the company during its fiscal year ended December 31, 2016, and the only opening general ledger account balances were Cash - $5,000 and Share Capital - $5,000. After the May and June transactions are recorded, the general ledger T-accounts would appear as follows:

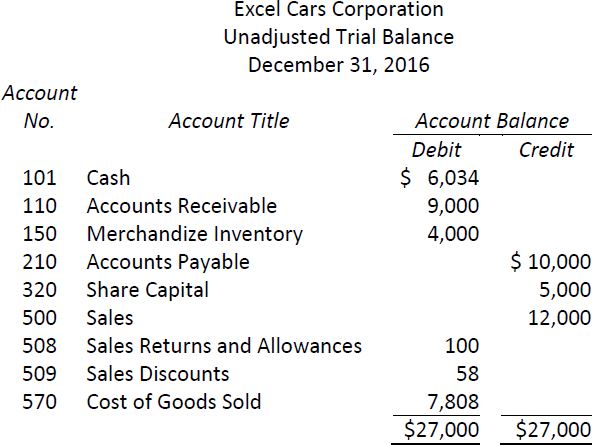

An unadjusted trial balance would be prepared based on this information, as follows:

- 2651 reads