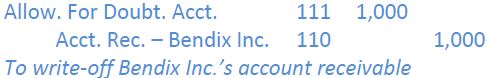

When recording the adjusting entry to estimate uncollectible accounts receivable at the end of the period, it is not known which specific receivables will become uncollectible. When a specific account is determined to be uncollectible, it must be removed from the accounts receivable account. This process is known as a write-off. To demonstrate the write-off of an account receivable, assume that on January 15, 2016 the $1,000 credit account for customer Bendix Inc. is identified as uncollectible because of the company’s bankruptcy. The receivable is removed by this entry:

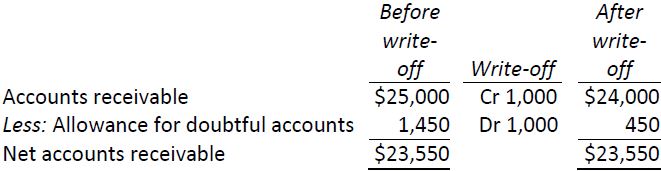

The $1,000 write-off reduces both the accounts receivable and allowance for doubtful accounts. The write-off does not affect net realizable accounts receivable, as demonstrated below.

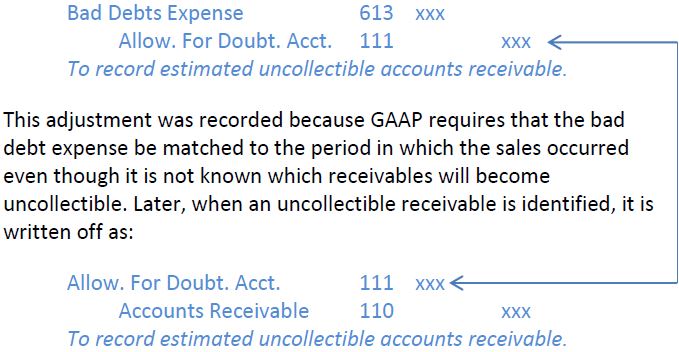

A write-off does not affect bad debt expense. Recall that the adjusting entry to estimate uncollectible accounts was:

The allowance for doubtful accounts entries cancel each other out so that the net effect is a debit to bad debt expense and a credit to accounts receivable. The use of the allowance for doubtful accounts contra account allows us to estimate uncollectible accounts in one period and record the write-off of bad receivables as they become known in a later period.

- 8764 reads